How to… make payments cost effective

Payment is a perennial pain point in restaurants and bars, and the experience can take the shine off even the most special occasions for guests. To explore how it might be refined, The Caterer conducted research in partnership with Barclaycard before discussing the outcome with a group of operators. James Stagg reports

What is the most popular form of payment in your operation? Are wearables on the increase or are they a fad?

Phil Somjen (PS): It's difficult to say, as it all comes through as a contactless payment, but we've certainly seen a rise in contactless. André Mannini (AM): Certainly phones, but we've not seen too many wearables.

Abdul Yaseen (AY):

Are there any regional variances?

James Hacon (JH): Itâs definitely regional. We stretch from Aberdeen to Bath and the cash to credit card ratio differs massively. As a business we take 70% credit card, 26% cash and the rest is invoiced. That changes hugely in the south, where there is a higher propensity to credit card transactions, to Liverpool, where we take only 40% credit card transactions and the rest is cash. I spoke to three managers this morning and itâs the same case for wearables. The Liverpool manager said heâd never seen anyone pay by phone, while in Guildford and Oxford itâs on the increase, with one in five or six doing so.

Ben Walton (BW): Because we have touch-andgo in this country, mass adoption of mobile payment isnât as likely as somewhere like the US, where hardly anywhere has chip and pin, let alone contactless. Weâve found that because of contactless the take-up rate of payment apps is low â" people will take up the opening offer but wonât use it again. But I expect that to change.

Paul Manktelow (PM): The US market is very different from the UK â" itâs certainly behind where we are. From an operator perspective, there was a big shift in 2004 to chip and pin. It was actually a headache at the time, slowing down service. Now we have contactless, which takes some of that pain away, but I wonder whether something is stopping consumers from using mobile payment.

Does something else need to drive that behaviour? And how might driving that benefit the whole chain, operator included?

JH: I think thereâs a point where it gets to a certain size and becomes acceptable and enough retailers offer it. I regularly use Apple Pay but I canât leave the house without a credit card as some operators offer it and some donât. As a consumer, Iâd rather carry a phone and not need to worry about anything else, apart from a way of charging it. The great thing about paying on your phone is you have a clear notification of what youâve paid. With a contactless card, you donât have that same reassurance.

PS: The transaction limit is also higher using mobile payments, but not many people know that. Itâs actually £100. If more people knew, theyâd be more inclined to use it.

PM: Educating people about it is really hard and we first found that through contactless. We first deployed it around 2007 and adoption was slow. I met with a coffee company at the time that was a cash-only business and did a pilot to show what it would do for its takings. We found that average transaction value went up 140%. When Transport for London launched Oyster cards, that changed behaviour and contactless became part of life for Londoners. The same needs to happen for mobile payment.

Do you care how someone is paying as long as theyâre paying?

JH: I think we do. We have grab-and-go in some of our restaurants and there itâs imperative to encourage people to use contactless for speed. I know of a bakery that is looking at actively moving away from cash in its six main London stores â" not just by being credit card-only, but contactless-only, because of the amount of time it takes to pay.

AY: About 30% of our guests come from the outskirts of London and many of them come with cash as they want to budget. We try our level best to deter that as itâs problematic having too much cash in the business. As an operator who

also has a grab-and-go offer, we want to encourage contactless, particularly at lunchtime.

What impact do alternative payment methods have on tipping?

JH: Itâs a massive issue. Regardless of what we decide on as a business, your staff have to buy into it. The problem is that as we donât have a service charge, staff will encourage people to pay cash as the belief is that they will get a cash tip. We even have cases of them skipping through the tip bit on the credit card machine. Iâm now trying to educate frontline staff to tell them that most people donât carry cash, so theyâre only fiddling themselves. But a real issue is that in a busy bar we have in Edinburgh, one barman told me that he tells those who want to pay through contactless that we only have chip and pin, as if they use contactless he wonât get a tip. Thatâs a real issue.

BW: Itâs often the case that guests donât have cash, so by not offering them a tip through the card transaction, the employee loses out.

PM: So it seems as though the gratuity piece is overdue an overhaul.

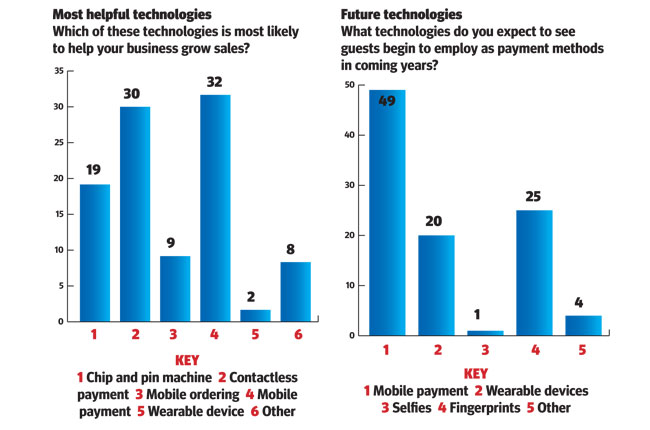

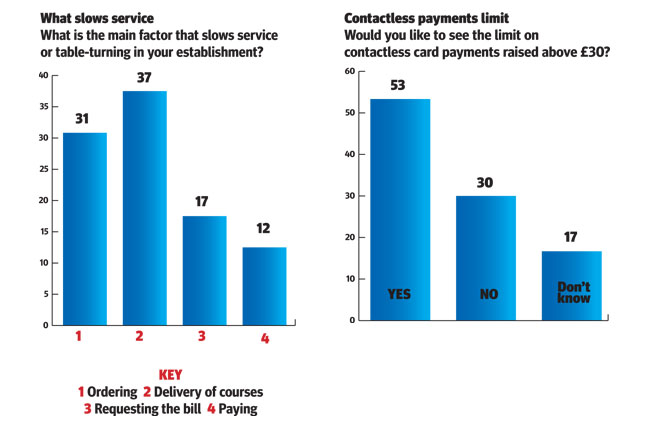

In our survey, 40% of people said mobile payment and ordering would grow sales.

Is that borne out in your experience?

BW: Again, itâs geographical. If people pay by card, the spend tends to go up.

PS: It definitely speeds up service and enables us to take more on a given night. Contactless makes things simple, and as weâre not really tip-heavy, it doesnât have too much impact.

AM: The opportunities are huge in terms of data collection too, so youâre able to create guest profiles. This data means you can understand your guests better and grow sales. At our new site in Twickenham, weâre in a complex with 200 flats and weâre using an app to offer room service to the apartments.

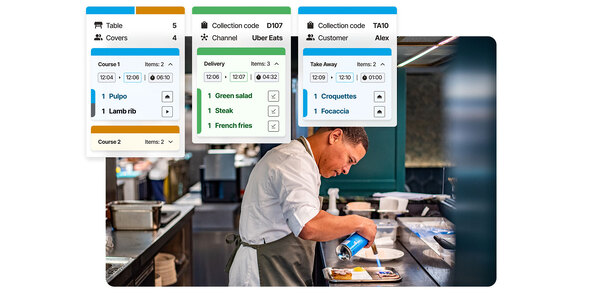

JH: The whole problem with app ordering and payment is interfacing it with your EPoS. We serve 35,000 people a week and to do that and work across multiple systems would be a huge pain. I can see a consolidation where the likes

of Deliveroo step into being the payment app for restaurants and become the transaction and loyalty provider.

BW: Choosing a new EPoS system is impossible and you become paralysed trying to work out what will integrate.

Has anyone experimented with ordering and payment apps?

JH: Weâve trialled two, and when I first arrived, there was also a company app. The download level was great at first as we incentivised it, but then usage was on the floor. Thatâs where it seems to be at the moment. Weâre looking at at-table screens. Guests ordering second drinks are an issue, so by having a tablet, it encourages ordering. Plus you can pay through it but, again, the main issue is EPoS integration.

BW: Iâd like something on the tables to encourage that second drink, but it isnât always the most attractive solution. However, it does remove the fear factor as people can see exactly what something is and learn in a comfortable way.

AY: It also removes the issue for people who donât drink alcohol, as guests can buy their drinks individually.

PS: When I go out, Iâm not keen on using a screen in a restaurant, but I used to work for a Champagne bar where we just had a button to order more Champagne.

JH: For us, Chaophraya is a celebration restaurant and I wouldnât look at anything that wasnât discreet. On the other hand, Thaikhun is for families and students and it has a large LGBT community, and on the basis of that demographic, it would make sense.

If you could start again with no existing payment system and design your customer experience, including payment, what would it look like?

JH: I think guests would register a payment method at the beginning of the experience, and then at the end, they can simply walk out and itâs done â" a bit like using Amazon. If thereâs then any level of question, you can go online afterwards and make a query. That would be the most convivial way. You look at the customer journey and it goes up, up, up â" and it drops off when it comes to payment. The last part of the evening can become unnecessarily stressful, particularly when splitting the bill.

BW: Ideally, you could walk out and the transaction is done. It does away with that sinking feeling at the end of a meal. I could be like Uber: you arrive at your destination and just get out. Thereâs no fiddling with cash or tips.

Laura Barrett (LB): Itâs probably why Nandoâs sells such a simple experience. Everyone pays for themselves in advance, youâre hungry at the start so you over-order, and at the end when you want to leave, you can just walk out. As a casual-dining experience, itâs ideal, as the service seems quick. You usually donât add a tip but theyâre only bringing the food over anyway.

PM: Many technology companies are trying to solve these problems individually, but it seems there will be that âUber momentâ when it all gets pulled together. Itâs interesting whatâs been said about invisible payments, as Barclaycard has been piloting grab-and-go internally in our canteens. Iâm sure that once that has been reviewed and signed off, it will come to market. It has certainly been well received.

What is standing in the way of this smooth guest experience? Do you use an integrated payment system where the PDQ speaks to the EPoS?

JH: I feel a major issue in our sector is that weâre held to ransom by no more than 10 technology companies that wonât play fair with open interfaces. Some believe they can solve the whole problem themselves, but thatâs just not the reality. Most of us would be with EPoS providers that fit in that bracket.

PS: We attempted integration, but when POS talks to PDQ, the whole till is out of use. So when weâre serving hundreds of people on a Friday and Saturday night, nobody can ring up a drink. That just doesnât work for us. If anything goes down, we have huge problems.

PM: Particularly in hospitality, there doesnât seem to be that level of investment in payment infrastructure. The industry doesnât see the value in it. But perhaps those third-party payment service providers should be having the right level of conversation with operators.

PS: I think it comes back to the fact that the EPoS system often has the difficulty integrating. You can get the middleman on board, but if your till system isnât able to go down that route, it canât be done.

JH: The problem is that none of the ordering and payment apps have reached a point of market penetration that makes it worth us being on those channels.

How do you see payment developing?

JH: I know other restaurant groups are looking at it, but weâre starting again. The pressures on labour and wages are encouraging us to do that. We have a restaurant put aside where weâre fundamentally changing the way it operates. Currently, the pain point at the end of the scenario affects our sales. We want to get restaurants working utterly effectively when it comes to technology and payment.

PS: We need streamlined integration of the EPoS function to stop so much reconciling. Guests should order from the table and either have it brought to them or they collect it â" thatâs an option too, though it doesnât encourage interaction. We want to drive spend by taking cash out of the equation.

PM: Technology around service is set to have a part to play. In terms of apps, there needs to be consolidation, as a smartphone screen is precious real estate. If someone can house several brands, thatâs when it gets exciting.

Sponsorâs comment

Barclaycard is a payment solution expert for businesses in the restaurant, pub and

Barclaycardâs people are true thought leaders and are at the forefront of payment innovations, understanding market trends to offer views and commentary on relevant topics to help businesses be more successful.