What innovations will drive post-pandemic hospitality?

The devastating wave of closures caused by the pandemic could be a driver for innovation in the sector. Janet Harmer looks to The Caterer’s Hospitality Business Leaders Survey 2021, compiled by CGA, to discover what operators have identified as potential growth opportunities.

In a time of great uncertainty, one thing that is clear is that the pandemic has resulted in a fundamentally changed UK hospitality market in both size and shape.

However, while the sector is smaller than it was pre-Covid, there are signs that the closures that have already taken place – and more are expected to come – will open up opportunities for those keen to embrace the new order of things.

That is certainly a key conclusion of The Caterer’s Hospitality Business Leaders Survey 2021, compiled by CGA, in which 170 individuals were questioned during April. The extent of closures is stark, with operators saying that an expected 9% of hospitality sites are unlikely to reopen once all restrictions are lifted on 19 July. Some 22% of respondents believe they will permanently close a portion of their estate, a figure that rises to 44% for contract caterers.

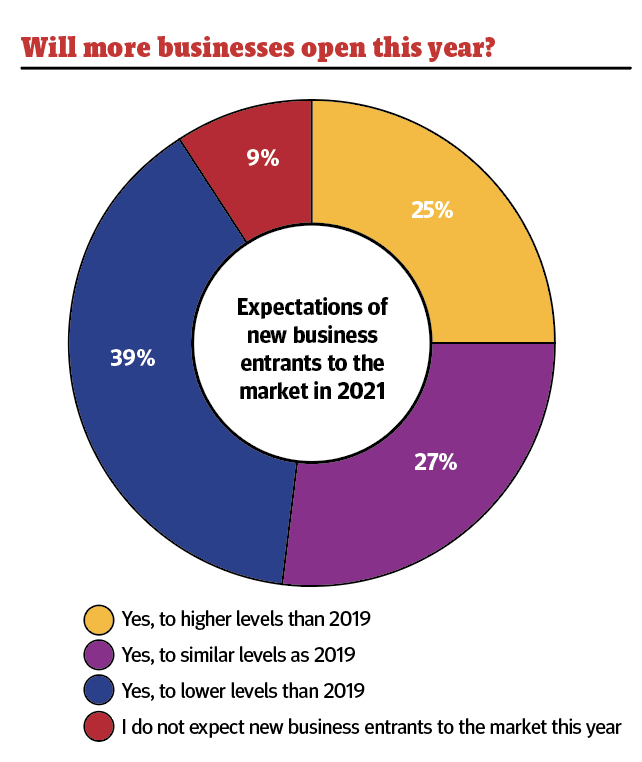

On the flip side, the majority of business leaders anticipate that there will be a number of new entrants into the market this year, a situation that workplace catering consultant Chris Stern says proves “the resilience of the hospitality industry”.

A quarter of those surveyed optimistically expect there to be more newcomers to the sector than there were in 2019, while a slightly higher 27% believe the number will remain at the same level as 2019.

Hotel industry consultant Melvin Gold says the fact that a healthy number of openings is being predicted at the same time as closures taking place is not as inconsistent as it might first appear. “A significant number of mostly branded hotels are already in the pipeline and, while some projects may slow down, they will open,” he says.

“At the same time there are a number of restaurants and pubs that have closed on what is essentially a good site, providing someone else with the opportunity to come along with a different business model and invest in a new opening. The fact that there will be new entrants coming into the market is a sign of light.”

Charlie Mitchell, research and insight director at CGA, agrees that there will be many “opportunistic” entrants into the market. “Lockdown has given people the chance to think of a career change and maybe consider opening a pub or other outlet,” he says. “We could therefore see a new wave of innovation.”

Closures, of course, have taken place for a myriad of reasons, with the writing on the wall for some time before the arrival of Covid-19 for a number of casual dining sites due to the overcapacity within the sector. At the same time, some businesses that were previously operating strongly before lockdown have chosen not to reopen because leases are nearing their end.

“Consumer demand is not going away,” explains Mitchell, “So if supply dips, there will be an imbalance, resulting in new entrants into the market.”

Quality over quantity

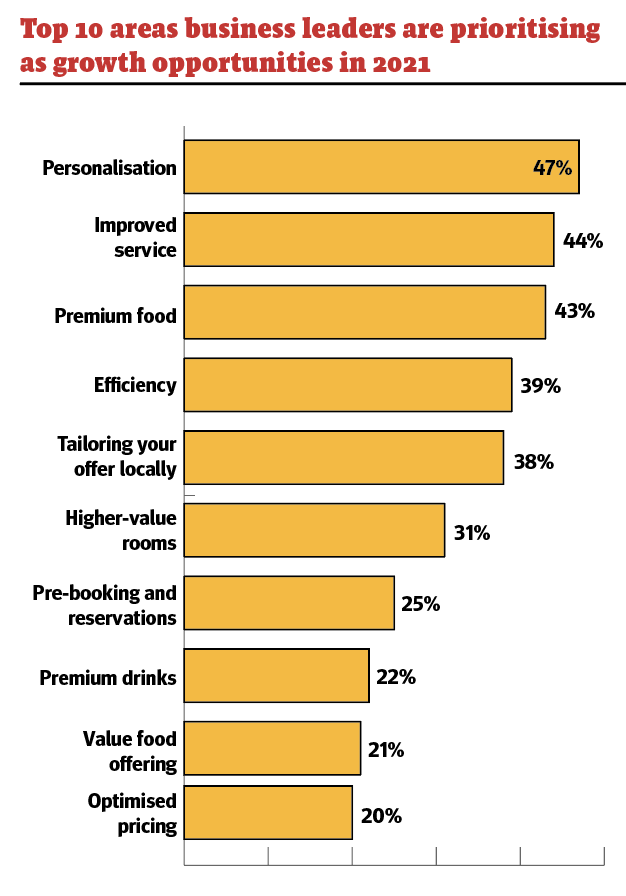

When it comes to the key priorities for business leaders to provide growth opportunities in the coming year, the focus is clearly on offering customers a better experience. The top three areas they highlight include personalisation, as mentioned by 47% of respondents, improved service (44%) and premium food (43%). Less significance was given to premium drinks (22%), value food offering (21%) and optimised pricing (20%). Similarly, the most important factors encouraging a sense of optimism among those surveyed are product quality (highlighted by 80% of leaders), customer service (76%) and food quality (72%).

Foodservice consultant Peter Backman wonders whether leaders are prioritising better quality food and service because that is what consumers want or because they think the competition is tough and they need to up their game. “Fundamentally, there is a shift in customers demanding more quality,” he says. “Following the Spanish Flu, there was a lot of excitement about the dawn of a brave new world and I think we may see some of that now. People certainly want things to be better and, in the foodservice environment, that means better food, service and experience.”

Lessons learned

The increased levels of service that operators have had to put in place in order to be Covid-compliant have been welcomed by many customers and may well stay in play in some outlets. “Personally, I would like to see a continuation of table service in pubs, whereas some people would prefer to order their drinks in the scrum at the bar,” says Backman.

Mitchell believes that there is now the opportunity for operators to offer different styles of service, be it via phone apps, bar service or table service. “It is a challenge, but if operators can crack it, the increased levels of direct service will provide an opportunity to upsell and encourage repeat visits.”

Being forced to operate businesses in a different way has taught the industry a great deal during the pandemic, which ultimately will benefit the customer, believes Gold. “The use of technology for check-ins, accessing menus and paying bills has accelerated quickly, and many of these things are now here to stay.”

Preparing food for click-and-collect orders is new for a lot of outlets and is currently being offered by 37% of businesses, according to the survey, with a further 11% of leaders saying they plan to implement them. However, the majority (53%) don’t intend to introduce the concept. Fewer leaders still say they use third-party companies, such as Deliveroo and UberEats, to deliver alcohol and drinks (11%) and food (13%), with just 5% and 9% planning to work with them to deliver alcohol/drinks and food respectively.

Stern says that while click and collect in the home market is here to stay, he predicts a reduction of it in the workplace. “It is better to look before buying and it’s easy to do so there.”

With more people returning to bricks and mortar hospitality outlets, it is clear that the experience is all-important. This goes some way to explaining why 34% of business leaders say that experience-led concepts – more than any other sector – are set for a positive 2021. Less confidence is shown for hotels and independent restaurants, with just 20% and 14% of business leaders respectively being optimistic for these areas, and just 3% of them believing that bars will do well this year.

“People have missed going out to eat and drink,” says Gold. “While many have suffered, there are also many that have got money who relish the return to the hospitality experience by embracing quality within a safe and secure environment.”

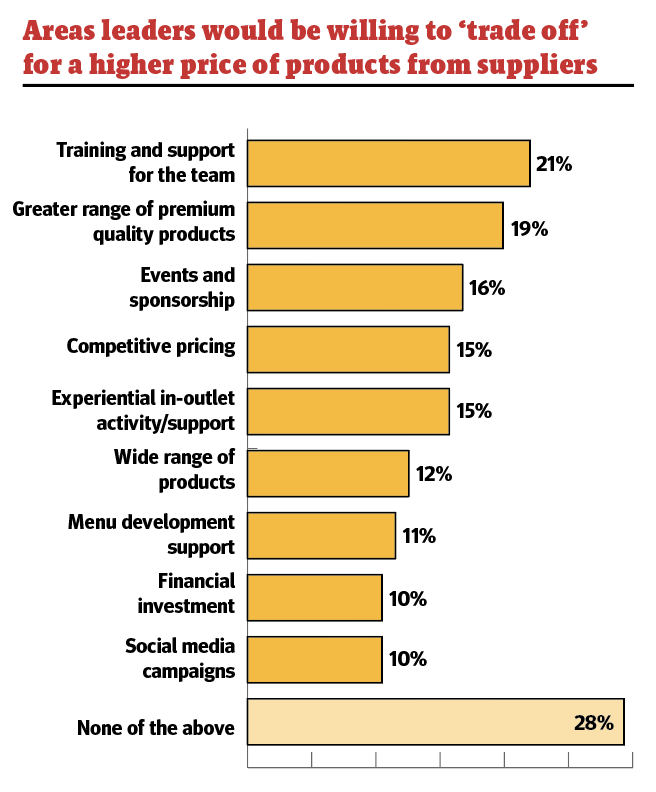

Looking at ways that suppliers can support business leaders this year, the majority (65%) say competitive pricing is the most important, followed by training and support for the team (41%) and enhanced ordering and delivery systems (20%).

When asked what business leaders would be willing to ‘trade-off’ to compensate for higher prices, the answers are split across a number of incentives including team training and support (21%), a greater range of premium-quality products (19%), and events and sponsorship (16%). However, 28% of respondents said that they were not willing to pay a premium for any reason.

Hospitality Business Leaders Report 2021

The full Hospitality Business Leaders Report is available to The Caterer Gold Club subscribers.

It features analysis of sentiment among leading figures in the industry taken in late April 2021, exploring the future for hospitality, the formats tipped for success, how operators are executing their reopening strategy and where they are prioritising their marketing.

View the Hospitality Business Leaders: Building Back Better report