Where's the next hotspot for European tourism?

It's been a tumultuous year for Europe, but according to a report by Christie & Co, it didn't dampen tourist spend. James Stagg reports

Europe remained the most appealing and visited region in the world in 2017, with the UK the most searched for destination on the continent, according to a new report.

The European Travel Trends and Hotel Investment Hot Spots report by Christie & Co found that visitor growth to Europe was up 1.5% in 2016, and predicted that it would grow a further 2% in 2017. In fact, Europe had three times the international visits experienced by the Americas and twice as many as Asia and the Pacific in 2016.

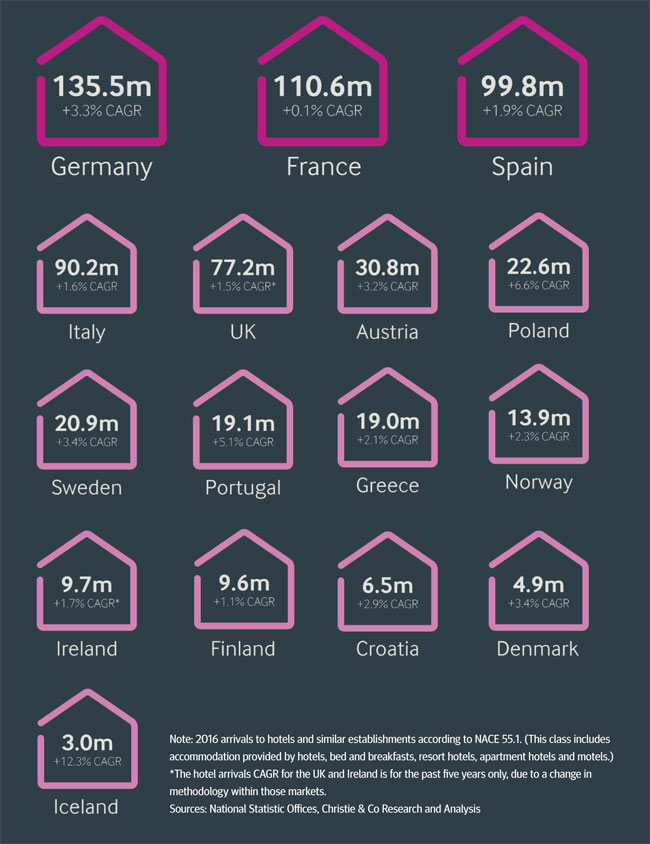

European travellers remain the key source for European destinations, with domestic travel accounting for almost 90% of demand. The UK and Germany had the highest domestic demand, with 75% of arrivals being local travellers, driven by strong business travel markets. The top markets for hotel arrivals were Germany, France and Spain, accounting for 346 million visitors in 2016. The UK was the fifth most popular nation for visitors, up 1.5% at 77.2 million.

The figures demonstrated that from a domestic point of view, recent terrorist activity in Europe had made little impact on travel.

That said, there has been some displacement from one European country to another. Where visitor growth has slowed in France and Belgium, Spain and the UK have gained. Significant growth in other European countries has mitigated any loss. London remains the most popular UK visitor destination, with London Heathrow the busiest airport in Europe, but Christie & Co associate director Marine Duchesne said that in terms of investment there was significant interest across the UK.

She added: âEveryone wants to be in London, but the truth is opportunities are rare and yields are low. âThere are other amazing markets in the UK â" particularly Manchester, Edinburgh and Glasgow, as well as smaller cities like Bath and Bristol â" where you can really add some value. If you look at transactional activity recently, there has been huge performance in secondary locations, with money from Asia, Europe and the US investing in cities such as Norwich that might even be perceived as tertiary in the market.â

The report identified booming demand from India and China, though in the short term China was considered a hotter prospect as the population are more established travellers.

It also suggested that demand from the US was set to rise, with only 23% of the population travelling in 2016 and the baby boomer generation retiring and seeking experiences.

Though Christie & Co identified opportunities in European nations such as Iceland, Poland, Denmark and Portugal, with strong revpar increases expected, Duchesne said that the established markets would still lead.

âAny investor looking at Europe has been looking at the UK, France, Germany and Spain, so weâre just trying to ask people to consider other markets,â she said. âWeâre not saying these countries are not a hotspot, weâre saying there are other more uncommon markets to look for.

âBut in the UK the GDP forecast is somewhat hampered by the Brexit negotiation, so there is expected to be less revpar growth. That doesnât mean we expect to see less interest in the UK, because it is a somewhat safer market than Portugal for example or Croatia.â

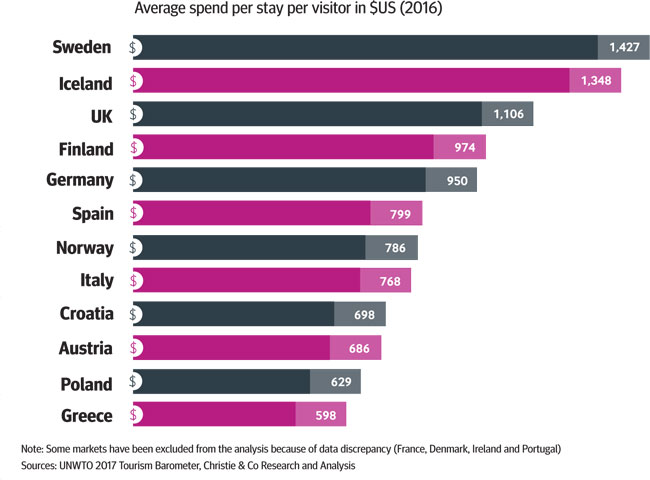

A large spread between northern and southern Europe

Beyond the volume of visitation, the actual value created by visitors is a significant data point to analyse and compare between European markets. The graph below illustrates the average spend per international visitor during their stay in the respective markets. While these figures, shown in US dollars, are impacted by exchange rates and length of stay in the different markets, we see that the Nordic markets (Sweden, Iceland, Finland and Norway) are reportedly expensive destinations overall, while Southern markets appear to be more affordable.

The top European hotel destinations

The Christie & Co European Travel Trends and Hotel Investment Hot Spots focuses on 16 primary destinations that together constitute the majority of European tourism: Austria, Croatia, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Norway, Poland, Portugal, Spain, Sweden and the UK.

Although Europe remains extremely attractive overall, the landscape is mixed in terms of hotel arrivals across the different regions. In 2016, the top three markets in hotel arrivals â" Germany, France, and Spain â" accounted for 346m visitors or close to half of total hotel arrivals among the analysed markets, while a number of markets welcomed fewer than 10m visitors. Albeit not significant in absolute terms, some of these smaller markets, such as Iceland, Poland and Portugal, have experienced very strong hotel arrivals growth in the past 10 years.

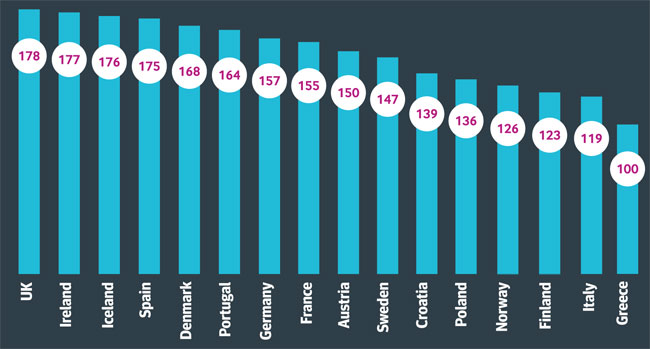

Where are more hotel rooms needed?

Hotel demand in Europe is strong, but how does this compare to hotel supply? Christie & Co used the Overnightto- Bed ratio (2016), calculated as the volume of hotel overnights divided by the number of available beds in a market, to identify supply gaps, and hence potential development and investment opportunities. Needless to say that this ratio varies from one market to another within countries, and thus should be interpreted with caution.