Tips, service charges and troncs: what the government proposals mean for hospitality

The government review of gratuity practices has ended, prompting an eight-week consultation period on the proposals. Amanda Afiya and Neil Gerrard encourage operators to speak up and ensure the ball is in hospitality's court

Leading operators, associations and advisors are urging the hospitality industry to grasp the implications of the government's proposals concerning tips, service charges and troncs at speed, if it wants to have any meaningful influence on the outcome of a consultation process that will run for just eight weeks.

The government announced the outcome of business secretary Sajid Javid's eight-month review of tips, service charges and troncs on 3 May and the industry has until 27 June to engage in the consultation process.

But do hospitality businesses, their employees and the public really understand what could be at stake? There is still a great deal of work that operators need to do to clarify what the proposals really mean and some commentators have warned that there is little real detail about how the government intends to make its proposals work in practice.

Kate Nicholls, chief executive of the Association of Licensed Multiple Retailers (ALMR), told The Caterer: "Some interpretations of what the government is saying could mean little change to current practice, and others could mean a wholesale change at significant additional cost, particularly for small businesses.

"There is a real danger that if we get this wrong, that workers will be worse off, and I don't think the government is aware of that."

Restaurateur Joel Kissin, who runs Boulestin in London's St James's and is the former managing director of Conran Restaurants (now D&D London), echoed Nicholl's concerns, and said: "It has been my observation that not only do the public not understand the benefit of a separate, optional service charge, but neither do many restaurateurs.

"Restaurateurs also don't understand why there is a national insurance exemption. I attended a meeting last week run by the Alliance of Independent Restaurants and there were about 60 people around the table. I said, ‘Hands up who understands what the National Insurance exemption does'. One hand went up, and I have to admit that I didn't understand the minutiae myself until recently. The industry does not understand the issues.

Harry Murray, chairman of Lucknam Park hotel and spa in Colerne, Wiltshire, certainly wants to see the industry shrug off its apparent apathy: âWe cannot sit back and allow the government to make the decision. If we are to improve the industry, this is an opportunity to ensure complete transparency for all stakeholders.â

The proposals

So what are the governmentâs proposals and what could some of the potential dangers be? The government has indicated it would like to see restaurants handing over all tips to their employees. The proposals also suggest that charges imposed on staff tips by employers should be scrapped or limited (except for those required under tax law), and that service charges on customersâ bills should also be clear and voluntary. It is also considering:

- whether to ban or restrict the levying of table sales charges on staff â" a fee paid by waiting staff based on their sales during a shift;

- how to incentivise and increase the prevalence of well-managed tronc systems; and

- how to update the current voluntary code of practice and put it on a statutory footing to increase employer compliance.

One uncertainty is if the service charge could, as a result of these proposals, end up being made non-optional or abolished altogether.

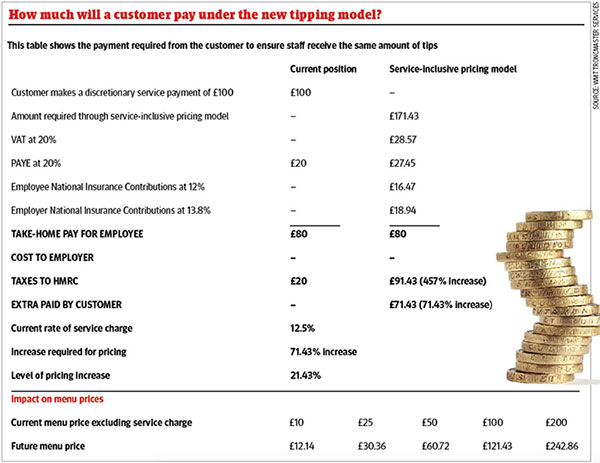

That is something that Kissin is strongly opposed to because, in his view, it means a worse deal for everyone: âThe public needs to understand that they are going to pay much more for their meal because of the huge increase in tax, should the service charge be abolished or made non-optional. Why does the government not mind that? Well, the government never minds getting more tax, and of course, they want some inflation, which they will get in spades.â

Tax expert Howard Field, who is part of the Tourism and Hospitality Special Interest Group Committee of the Institute of Chartered Accountants in England and Wales, is concerned that the review period leaves little time to tackle such a complex issue: âThe subject is riddled with out-of-date practices, lacks any common standards and is confusing to all of the parties involved. It cannot properly be dealt with in such a short space of time with such limited relevant input,â he said.

In an article posted on LinkedIn, Field stated that the length and scope of the governmentâs review on tipping, gratuities, cover and service charges âdoes more to illustrate the complexity of the subject than it does to identify and address the fundamental issuesâ.

Nicholls, whose organisation represents 90% of managed pub businesses in the UK and 7,000 casual-dining outlets, said: âFirst of all, we see no need for heavy-handed intervention and regulation in this area. There is no evidence that we have seen either from the government review, where you have got 49 employee responses back, nor from consumers, that there is this big issue of concern. Our survey of members found that there was widespread compliance. So what we donât want is a heavy-handed intervention that adds regulatory costs and burdens.

âHaving said that, obviously we are in a situation where the government has decided it wants to intervene. The area that we think it would be more appropriate to focus on is transparency, rather than the government interfering in commercial issues about how you recognise and reward people when you are in a fast-moving, competitive marketplace. The last thing you want to do is to stifle what people can do to reward their staff.â

The Caterer contacted the governmentâs Department for Business, Innovation & Skills in response to the industryâs concerns. A spokesperson for the department commented: âThis is an important issue and the government is determined to make sure workers who earn a tip are able to keep it. This eight-week consultation gives all parties time to share their views on our proposals.â

Time to engage

Tax expert Peter Davies, a former HMRC investigator and now managing director and co-owner of WMT Troncmaster Services, said it is critical that the industry engages in the governmentâs consultation process on tips, service charges and troncs.

âThe industry isnât engaging and, to be blunt, itâs got to get off its backside, because thereâs a real risk that by the time people realise whatâs going on, or get their heads around this subject, the bus will have gone.

âOnly 13 businesses responded to the government review â" thatâs just 7% of total respondents â" which is pitifully low, so itâs not surprising the government isnât getting the industryâs side of the story. What we need is not 13 businesses responding, but 1,300 or 13,000, because the bad practice that has been highlighted [by the press] is not representative of the industry.

âBy contributing to the consultation process, the sector can demonstrate what good practice looks like.

âSome of the proposals are going to happen â" such as transparency, thatâs a given â" and people have to accept that if you are going to ask customers to make a voluntary contribution, itâs not unreasonable for them to know what you are going to do with it. Everyone has to accept that.

âI believe the government is quite supportive of the idea of well-managed, well-run tronc systems. We need to show we are not churlish. Things like transparency probably should happen, and we need to put right some of the misconceptions out there.

âOverwhelmingly, the majority of businesses are not out there to rip-off customers, staff or do anything dodgy. The way that businesses operate is that they want to keep costs down, employ people, maximise the take-home pay for staff (for people who are modestly paid), and keep the price of the customerâs meal down. I think that has to be the message.

âIf we have to throw the baby out with the bathwater, the majority of hospitality businesses â" which are independent, small, single sites or, at most, a handful of sites â" are not going to be able to swallow the extra costs.

âThe only way of affording this is to pass the costs on to customers, and customers need to be aware that the price is going up â" not because the business is increasing its profits, not because the staff are taking home more money, but because more is going to tax.

âWeâve got seven weeks to get on the front foot and start putting that message out there. At the moment, the feeling is that everyone is tarred with same brush [as disreputable operators].

How the British Hospitality Association will respond

The British Hospitality Association (BHA) unveiled its code of practice on discretionary tips and service charges in July 2009, urging restaurants to be open with customers.

The code, produced in conjunction with the then Department for Business (now the Department for Business, Innovation & Skills), advised restaurants and hotels to disclose to customers how they will split discretionary service charges and non-cash tips.

BHA members agreed at the time to implement the code ahead of the governmentâs legislation, banning the use of tips to make up the National Minimal Wage from October of that year.

Speaking at the time, former BHA chief executive Bob Cotton said: âWeâve had too little information in the past about the way the service charge is collected, what it is for and who receives it. This has given rise to widespread criticism which has damaged the industryâs reputation. The code will ensure that restaurants make crystal clear how they distribute the proceeds of the charge, who gets it and what percentage, if any, is kept by the restaurant to cover legitimate costs.â

Last week, in response to the governmentâs review, Ufi Ibrahim, chief executive at the BHA, said: âTransparency is precisely what we asked the government to consider. Customers should be able to reward good service and know where their money ends up.â

âWe will convene a series of meetings with hospitality business leaders across the UK and conduct our own impact assessment to deliver a unified and robust response to inform the governmentâs decision-making process.â

Ibrahim continued: âMany customers struggle to understand the difference between a tip and a service charge. Whatâs more, they arenât always sure what happens to the money they leave at the end of a meal. We believe restaurants should provide a written notice explaining exactly what happens to service charges and tips.â

Â

What you think

Last week, The Caterer sent out an online survey to gauge the industryâs thoughts on the governmentâs review on tipping and service charges. Here is a small selection of your opinions and concerns.

âWe are an independent restaurant. We clearly state on our menus how cash and card gratuities are distributed and that we deduct an admin charge if the customer chooses to pay the gratuity by credit card. As a business we have to pay employer NI and this has typically increased by the healthy level of card gratuity our customers leave for our team members. Our credit card processing fees have also increased, so itâs imperative that while we fairly reward our team members, we are also not financially penalised as a business for providing the ability for our customers to choose to pay the gratuity by card rather than cash.â

âTeamwork is key in any business. So many people are involved in ensuring that the customer has the best experience possible. Saying that only the final waiter/waitress gets the tip will result in a massive difference in pay between staff, which in turn will result in a non-functioning team, which in turn will lead to a poor customer experience, and then the business going under. Require that all tips (cash and otherwise) are put into the tronc system â" so everyone is taxed fairly.â

âEmployers must be allowed to deduct the same commission charged by the credit card companies.â

âI feel like the government does not understand how small businesses within the hospitality industry operate and that they are seriously threatening our viability to keep our doors open. We cannot just continue to raise prices on menu items indefinitely to offset costs. But between the level of VAT in this country, the new National Living Wage (NLW), business rates and now interference with the gratuity system, I think they will start to see significant numbers of employers have to cease operations. To be clear, we run a quality-led, small village dining pub and we value and reward are staff as much as we possibly can. But margins are so tight and all of this is building up against us.â

âI am very much for the proposals. However, restaurant staff need to be aware this gives the Inland Revenue every reason to go after their share of the tips.â

âThe government will use this to raise tax. It has no other interest. Resist this vigorously.â

âWe need, as an industry, to make it clear that the vast majority of businesses do run fair tipping systems.â

âI think the general public understand that service charges are discretionary, but all the nonsense about tipping policies and management abusing it and making up minimum wages are greatly exaggerated and are having a detrimental effect on the overall amount of tips left for individuals. As to a ban on levying table sales charges, Iâm afraid that even I am not aware of this or what it means! The government needs to let up on the restaurant trade tips and pick up on other services.â

âWhatever happens, this is business-model changing! With the NLW and rates and rents on property, this has put this industry back two years. Even the strongest brands will feel the strain.â

âI have never added a service charge in 44 years of owning hotels and restaurants. I deplore the places that do.â

âI think it needs to be made clear who tips will be paid to â" itâs not just the waiting staff, but the kitchen team as well, because without good food the customer is unlikely to tip, so itâs a whole âteamâ thing.â

âI donât really think it is the governmentâs business to interfere but the bad practice is getting out of hand and hence we need legislation.â

âNothing has been said about the tax implications for staff if new legislations comes into force. As sure as eggs are eggs, this will allow HMRC to impose a structured tax on this income stream which will be far more damaging to staff than any benefit gained as cash tips will effectively be ruled out â" which, at the moment, go largely un-taxed.â

âThis industry is overwhelmed by legislation from every conceivable quarter. We donât need more. Staff should make it public if their employers or seniors are unpleasant, greedy people.â

âUnscrupulous operators bring the industry into disrepute. Gratuities should be given freely, without any sort of prompting or âtwisting of armsâ. Adding a âdiscretionaryâ service charge to a bill should be banned. All tips should be freely given and then distributed directly to the staff, under whatever method the staff agree upon, which may vary.â

âWhy is the NI cost that tips incur for employers never discussed?â

Do you agree or disagree with the comments above? Or is there another area that you feel should be mentioned? Email amanda.afiya@thecaterer.com or neil.gerrard@thecaterer.com with your thoughts. We welcome anonymous comments too â" just let us know that youâd rather not be quoted

Make your voice heard

The governmentâs proposals are currently out for consultation, in a process that lasts until 27 June this year

To contribute to the consultation, visit: www.tinyurl.com/jegy2ub

Or contact:

Labour Market Directorate

Department for Business Innovation and Skills, 1 Victoria Street, London SW1A 0ET labourmarket.consultations@bis.gsi.gov.uk

BHA bha@bha.org.uk

ALMR info@almr.org.uk