Things can only get better, says Christie & Co

A report by Christie & Co predicts an end to the uncertainty which has gripped the hospitality sector since the recession. James Stagg reports

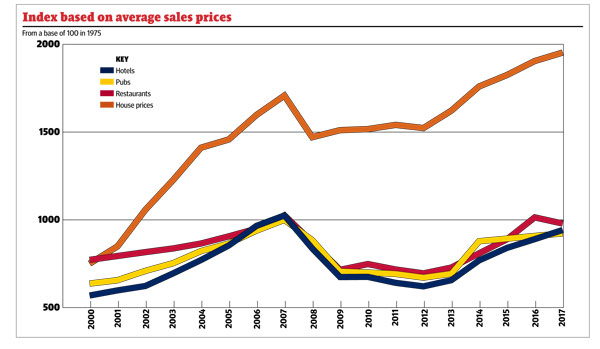

Having reported positive price movement in all sectors in which it operates, with the notable exception of restaurants, Christie & Co believes that the uncertainty that has held back activity for the past decade may have lifted.

Although consumer spending is being squeezed by higher inflation and slow wage growth, Christie & Co global managing director Chris Day says that there is much to be upbeat about for operators in 2018, particularly those in the hotel sector.

Day also predicts that there will be further consolidation as cost pressure continues to hit margins and drive greater efficiencies. He adds: âMoving forward, it is becoming increasingly important for businesses in all our sectors to harness evolving technology. New, authentic business concepts will be a key factor in 2018 and beyond. Independent businesses have proven time and again this is an area in which they can flourish. The challenge for the larger corporate operators will be keeping their product fresh, attractive and competitive, while at the same time keeping abreast of the latest trends and innovations.â

A bumper year for hotel transactions

Following a bumper year for UK hotel transactions in 2017, up nearly 18% year-on-year to £5.3b, 2018 is likely to show a slight decline in total sales. However, interest in hotel investments is still strong, with a new set of buyers, particularly from the Far East, showing interest, according to Barrie Williams, managing director of hotels at Christie & Co, speaking at the publication of the companyâs Business Outlook 2018.

âThe difference with the new buyers is that they are likely to retain an interest in their investments for longer â" maybe a whole generation â" than the usual five- to seven-year timeframe before an investor flips them,â he says.

Hotel prices increased by 5.8% in 2017, marginally lower than the 6% rise in 2016. The largest transactions last year included the £800m acquisition of the 36-strong Jurys Inn portfolio by Swedish hotel investment company Pandox, backed by Israeli-based Fattal Hotels Group, from US private equity company Lone Star Funds, as well as the £525m deal funded by Aprirose to buy the QHotels portfolio of 26 properties from Bain Capital Credit and Canyon Partners.

Whether such large deals will make it over the line during 2018 remains to be seen, but one portfolio that is widely expected to change hands is the 17-strong Grange Hotels collection, privately owned by three brothers, Harpal, Raj and Tony Matharu.

This year has already seen the largest single asset deal of the last 12 months â" the 241-bedroom Waldorf Astoria Edinburgh â" the Caledonian for £85m. Williams said he is not aware of any other single-asset hotels valued at more than £50m coming to market, but highlighted there is a lot between £5m and £25m.

In particular, he highlighted that Christie & Co is currently marketing the 154-bedroom Days Inn Liverpool for £12.5m. The company also has a portfolio of five Marriott hotels on the market, in Bradford, Newcastle, Norwich, Southampton and Sunderland, on behalf of Abu Dhabi Investment Authority.

Easily available debt from banks, financial institutions, peer-to-peer lending and even crowdfunding, together with forecasts of revpar growth of 2.4% in London and 2.3% in the regions, will help drive investments. Strong leisure business enjoyed by hotels last year â" up 20% â" is expected to continue to grow, depending on a continued weak pound.

âThe biggest concern for investors will be costs, particularly food and wages, and what it will mean to profitability,â said Williams.

Restaurant prices fall

Restaurant property prices have fallen as consumers move away from branded sites. Christie & Coâs Business Outlook 2018 reported that prices fell 3.4% in 2017, compared to rises of 14.1% in 2016 and 9.9% in 2015. Despite this, it reported a 30% increase in the number of sites sold.

According to Christie & Coâs head of restaurants, Simon Chaplin, the market has levelled out and good sites are now available at a more reasonable price.

He added: âWeâve had a lack of good sites in recent years, but towards the end of last year the market improved. That can be a mixture of things: sites with reasonable rents, or in great locations. If you can find a site with reasonable rents in a great location, youâre quids in.â

He predicted that âbrand fatigueâ was likely to kick in with consumers who now want to dine at outlets which offer an individual experience.

âThe market is demanding more specialists, especially in the lower-end fast casual,â he said. âPeople, particularly millennials and generation X, are going out more but spending less. â

People arenât so keen on brands now, thereâs less loyalty and they donât like to be pigeon-holed. They want something unique they can put on Twitter and Instagram.â

Referencing recent restaurant closures, Chaplin said burger restaurants in particular might once have been sit-down restaurants but are now more grab-and-go operations.

He said: âPeople are prepared to spend £25-£30 on a good night out, but that needs to be a combination of food, drink and atmosphere. The market in the middle â" which tends to be the family market â" is more likely to suffer.â

Chaplin advised those considering expansion to be patient and wait for the right location that suits their required demographics and footfall. âThere is definitely better value for money to be had,â he said. âThe market has reached a level where people are keen to transact.â

Pubs staying steady

Pub prices held firm in 2017, up 3.8% on the previous year, as the availability of good sites struggled to keep up with supply. According to Christie & Coâs managing director of pubs and restaurants, Neil Morgan, the pub sector has now reached a sustainable size after a period of consolidation.

âThereâs lots of demand compared to whatâs readily available, irrespective of cost pressures,â he says. Morgan adds there are now just over 49,000 pubs left in the market, 9,500 of which are managed. At the peak of the market there were 58,000 pubs across the country.

âIf you now take out the likes of Stonegate, Greene King, Marstonâs and Mitchells & Butlers, it leaves around 3,500 sites,â he explains. âSo you can understand why thereâs a lot of demand.â

Last year, 85% of the pubs Christie & Co sold remained operating as pubs, with only 8% sold as residential properties and 2% for conversion to retail convenience store use, suggesting that those pubs left are now lean and viable trading entities.

Meanwhile, restaurateurs are now entering the pub space having seen more value than is available on the high street. âWildwood and Ego Restaurants are two good examples,â Morgan says. âNot only do you have the restaurant space, but other areas such as parking, too, as well as vertical drinking areas which help in leaner months.â

These smaller, multi-site operators, typically running three or more sites, are on the rise, according to Morgan. They are able to operate a more agile business model, one that is able to deliver better management and improved customer experience overall.

He says: âTheyâve invested in these sites and remodelled them and are making a success of it. I think weâll continue to see the rise of the multi-site operator.

âWeâre also seeing a lot more pubs where theyâre converting upper floors or outbuildings into letting accommodation. Itâs a way to retain or increase margins.â

Distressing news

Cost pressure on hotels, pubs and bars will continue into 2018, Christie & Co predicts, making a dent in the bottom line and reducing margins.

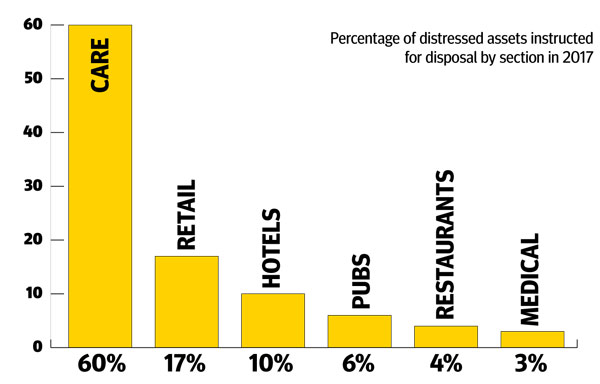

It says that if wage growth continues to be outpaced by inflation, consumers will reign in spending, hitting hospitality businesses the hardest. In 2017 the hotel sector put the most distressed assets up for sale among the hospitality industry, although of all the sectors Christie & Co specialise, it represented only 10% of disposals, compared to 60% in the care sector and 17% in retail.

The property agent predicts that business distresses will continue to rise in 2018, which would represent the first material change since the peak of recession activity.

In 2016, 4% of assets instructed for disposal were distressed, rising to 6% in 2017, and unfortunately this figure is expected to rise even further in 2018.

Videos from The Caterer archives