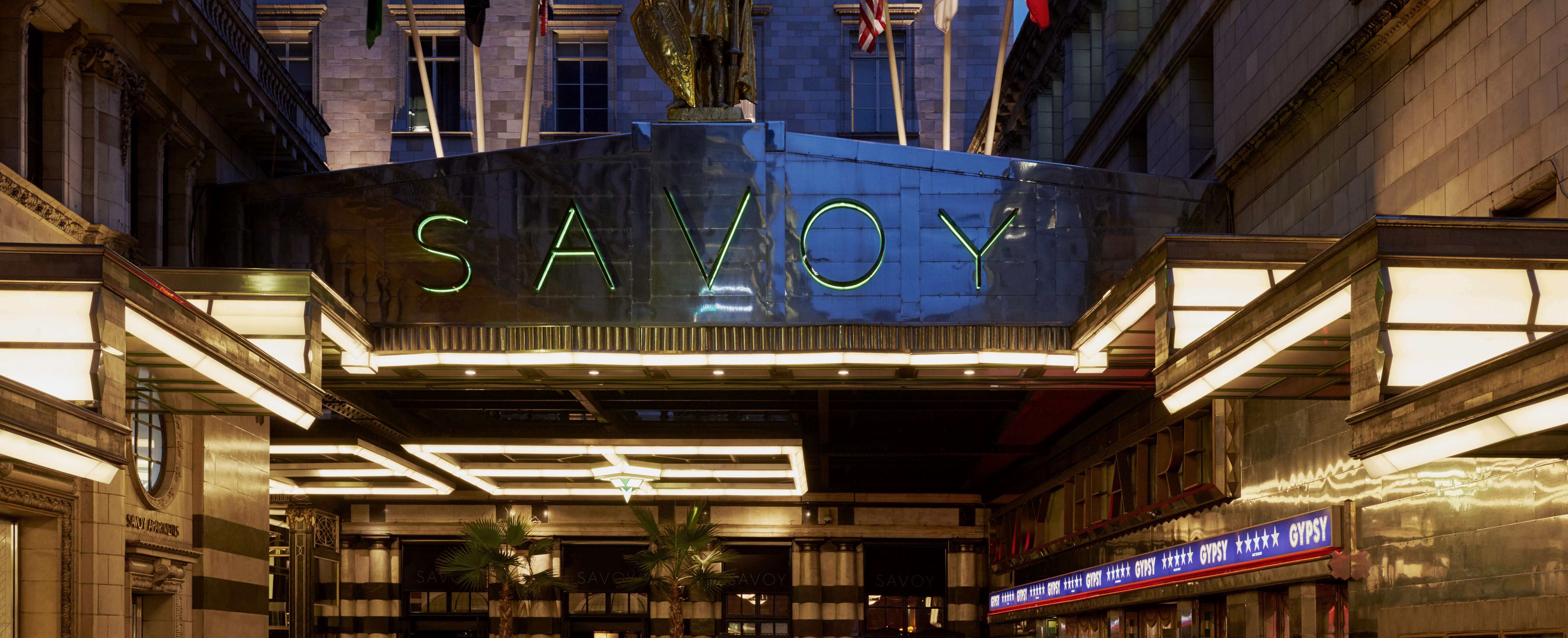

Savoy hotel confident in recovery despite £32m loss

Directors of London’s Savoy hotel are confident the business will recover despite suffering a £32.5m pre-tax loss in 2020.

Pandemic restrictions hit the 267-bedroom, five-red-AA-starred property which recorded revenue of £11.71m during the year, with sales dropping 82% and occupancy falling 58.7%, as well as a drop of 83% in revenue per available room (revpar) against 2019.

According to documents filed with Companies House for holding company Breezeroad, the hotel took the opportunity while closed to undertake some capital and maintenance projects that would have been difficult to do while it was open.

Since reopening, the hotel has experienced “significant demand in both rooms and F&B” and directors said they were confident operations “will return to normal in time” and that the group will continue as a going concern.

Hotel performance for 2021 was “encouraging” and “greater than expectation” with “significant” average daily rate (ADR) growth and a rise in demand for food and beverages, driven by the domestic market.

The Savoy is operated by Accor under the Fairmont Hotels & Resorts brand. The majority shareholder (59%) of Breezeroad is Kingdom Holding Company, of which the majority shareholder is Saudi Arabian billionaire businessman Al Waleed bin Talal Al Saud, while the remaining 41% of shares is held by the Qatar Investment Authority.