Creed Foodservice trends hub launches as operators look ahead to 2024

Ahead of 2024, one of the UK’s largest nationwide wholesalers Creed Foodservice, has announced the launch of the Creed Trends Hub; an online destination for hospitality operators to learn about the 2024 trends and how to bring them to life in their settings.

The Creed Trends Hub, which launched this week, houses sector specific 2024 Trends Reports, packed full of insights and learnings from Creed's Insights Manager, Anna Clapson, and practical guidance from Creed's Development Chefs, on how hospitality operators can tap into the trends in their kitchens and make them work on their menus

In addition, featured within the Trends Hub is the ‘Creed Trends Kitchen', with sector dedicated trend-led recipes that operators can incorporate into their menus, or use to inspire new dish ideas to freshen up their offering.

Speaking on the 2024 Trends, Anna Clapson, Insights Manager at Creed Foodservice, says: “We’ve poured weeks of research and expertise into our Trends Hub, to make sure we’re bringing the inside knowledge to operators who will continue to face challenging times next year. It can be overwhelming for operators to not only get to grips with the upcoming trends but then also find ways to link them back to their everyday operations. The Trends Hub is their digital guru, that they can access 24/7, whether that’s during late night menu planning, during their meetings, or in development sessions with their kitchen teams.”

Creed Foodservice’s 2024 Trends

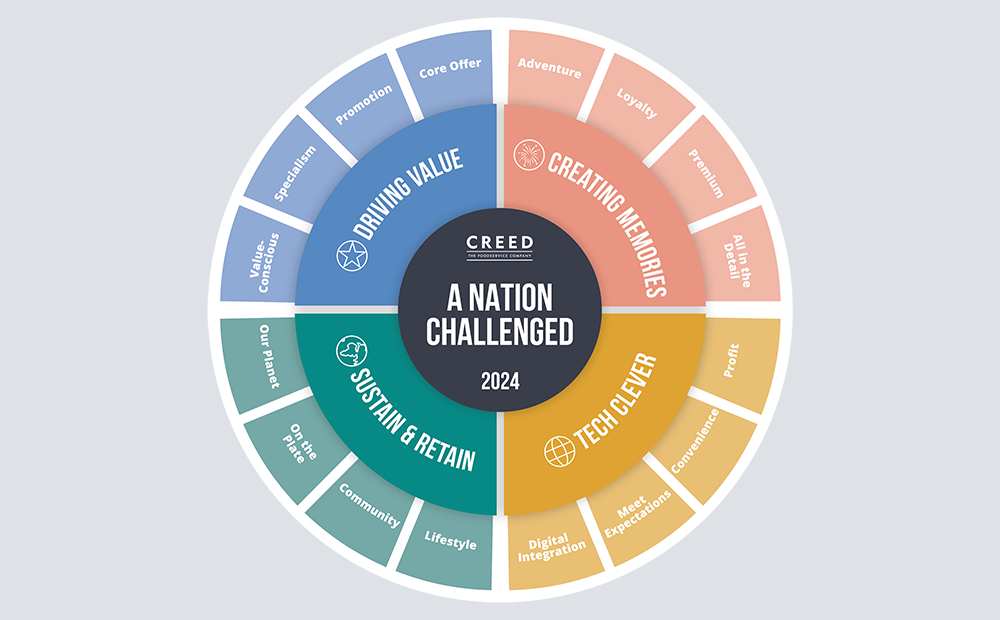

A Nation Challenged

At the core of the insights is the theme of ‘A Nation Challenged’, which underpins all the trends for next year. With inflation, energy prices, staff and skills shortages and financial pressures, both operators and consumers’ wallets are significantly impacted. Since March 2020, 14k+ sites have closed across the UK and 75% of consumers are going out to eat and drink less frequently.

Core Trend 1: Driving Value

Driving value doesn’t just refer to delivering low-ticket purchases; with the average food and drink prices on menus increasing, it’s also about strengthening the perceived value-for-money with well over half (60%) of consumers looking for value for money when choosing a location to dine at.

Operators can achieve growth through showcasing a specialism and honing in on a specific area of expertise. This is being seen at places like Ducie Street Warehouse in Manchester, which offers roast dinners with a menu dedicated completely to cauliflower cheese.

Core Trend 2: Creating Memories

With consumers’ heightened expectations, combined with being more selective with their spending, operators need to look at ways to elevate their food dishes from the everyday. A quarter (26%) of consumers look for an exciting or unique food and drink offering when dining out. Adventure can be shown through various cuisines, punchy flavours and enticing food formats – whether that’s themed dishes, tapas-inspired sharing boards, build-your-own burrito wraps, or inventive burger toppings.

Presentation is also important when it comes to creating memories and making a wow statement for diners. Simply serving curries in copper or iron dishes, with hammered or beaded finishes, immediately gives the dish a more authentic feel.

The customer experience can also be elevated through premiumising dishes; something which also justifies higher price points on the menu. This can be achieved by loading up classic sides like fries with truffle and parmesan or crispy bacon and onions, or offering ‘special’ accompaniments to chicken and steak, such as Persian spiced roast carrots with pistachio dukkah.

Core Trend 3: Sustain & Retain

Highlighting the focus on our planet and environment, consumers are far more conscious of where their food is coming from, with 38% looking for good, quality ingredients when choosing a location to dine out. There is also increased focus on seeking ‘better for you’ options with consumers welcoming knowledge of the nutritional content of dishes.

Sharing initiatives with customers is key – if you’ve taken the time and effort to source meat from nearby farms, vegetables from local growers, gin or ales from breweries in the region or cheeses from regional producers, this should be told to consumers through social media, displayed on the menu or through staff verbally telling people.

Core Trend 4: Tech Clever

Tech growth within hospitality has been significant in recent years. Increasingly consumers interact with restaurants and pubs digitally, enabling operators to communicate with their customers when they aren’t on the premises - whether that’s sharing menus, promoting a special or simply just booking a table.

Tech-driven solutions also offer consumers enhanced convenience, whether that’s ordering via a QR code on the menu, using click and collect for any takeaway dishes restaurants or pubs offer, or direct-to-the-door delivery services through third-party apps. Tech opens the door to new revenue streams which, in these challenging times, is advantageous for many operators.

To visit the Creed Trends Hub or to download the 2024 Trends Report please visit: www.creedfoodservice.co.uk/insights-reports-trends