Corbin & King repaying £34m debt following High Court rulings

London restaurant group Corbin & King is repaying a £34m debt after it was able to accept a rescue package following two High Court decisions over its financial arrangements.

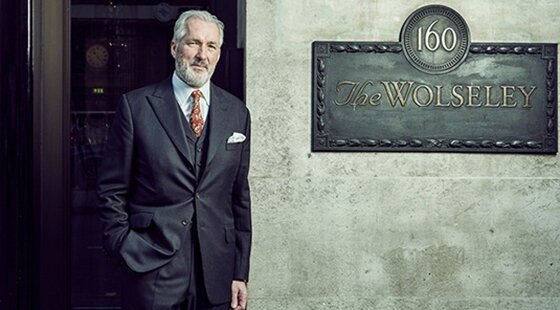

The group, which runs eight upmarket restaurants in the capital including the Wolseley and Brasserie Zedel, owed the debt to Minor Hotel Group (MHG) – a subsidiary of Thai hotel operator Minor International, which also owns MI Squared, Corbin & King’s biggest shareholder.

Corbin and King was placed into administration in January after failing to repay the debt when MHG called it in, but was also subject to a moratorium giving it two months' “breathing space” to explore rescue and restructuring options.

Last week, MI Squared, a subsidiary of Minor International which owns 74% of the shares in Corbin & King, asked a High Court judge for an injunction to prevent the group repaying its debt to MHG using a loan from the US-based CK Opportunities Fund.

Knighthead Capital Management and Certares Capital Management, which manage the fund, made an offer to buy the restaurant group for the amount of the loan when MHG demanded immediate repayment, but Minor rejected the offer.

MI Squared argued that the repayment of the loan to its associate company MHG would be in breach of a shareholder agreement between itself and Corbin & King’s directors, including Chris Corbin and Jeremy King.

However, Mr Justice Foxton concluded it was not appropriate to grant the injunction sought, finding that while both parties would be likely to suffer adverse consequences, it would be worse for Corbin & King.

The judge said in his ruling that there had been “a substantial falling out” between MI Squared and the directors of the restaurant group, who had issued “unfair prejudice” proceedings against the Minor subsidiary.

MHG demanded repayment in January of a £14m loan which had fallen due for payment in 2020, and a further £20m which was due in 2024 but was able to be called in because of the previous default.

Mr Justice Foxton said the decision to take the loan from the CK Opportunities Fund was open to the directors because it was on more favourable terms than the MHG loans and because MHG was demanding immediate repayment and the appointment of directors, while the fund was not.

He also said the decision to enter into the proposed new loan was backed by independent monitors, who were assigned to the group as part of the moratorium.

Lawyers representing MI Squared argued that, because the proposed new loan was “arranged in secret” without the knowledge of Minor, and because it was from a source which was content to allow directors Corbin and King to have a “continuing role” in the restaurant group, the judge could infer that the directors were motivated by “an improper purpose”.

However, the judge said he was unable to conclude the decision not to include either MI Squared or MHG in the development of these proposals was anything other than “another manifestation of the poor relations between the respective sides”.

In a further High Court ruling last week, Sir Alastair Norris concluded he would have dismissed an application by MHG to bring an end to the moratorium.

However, he said in a written ruling on Thursday that, while he was preparing the judgment following a hearing earlier in February, he was “told that the loan was in the course of being repaid”.

The CK loan is also intended to pay a £4m debt to HSBC and £600,000 to the landlord of the Wolseley Cafe in Bicester Village shopping centre near Oxford.