Where have all the hospitality workers gone?

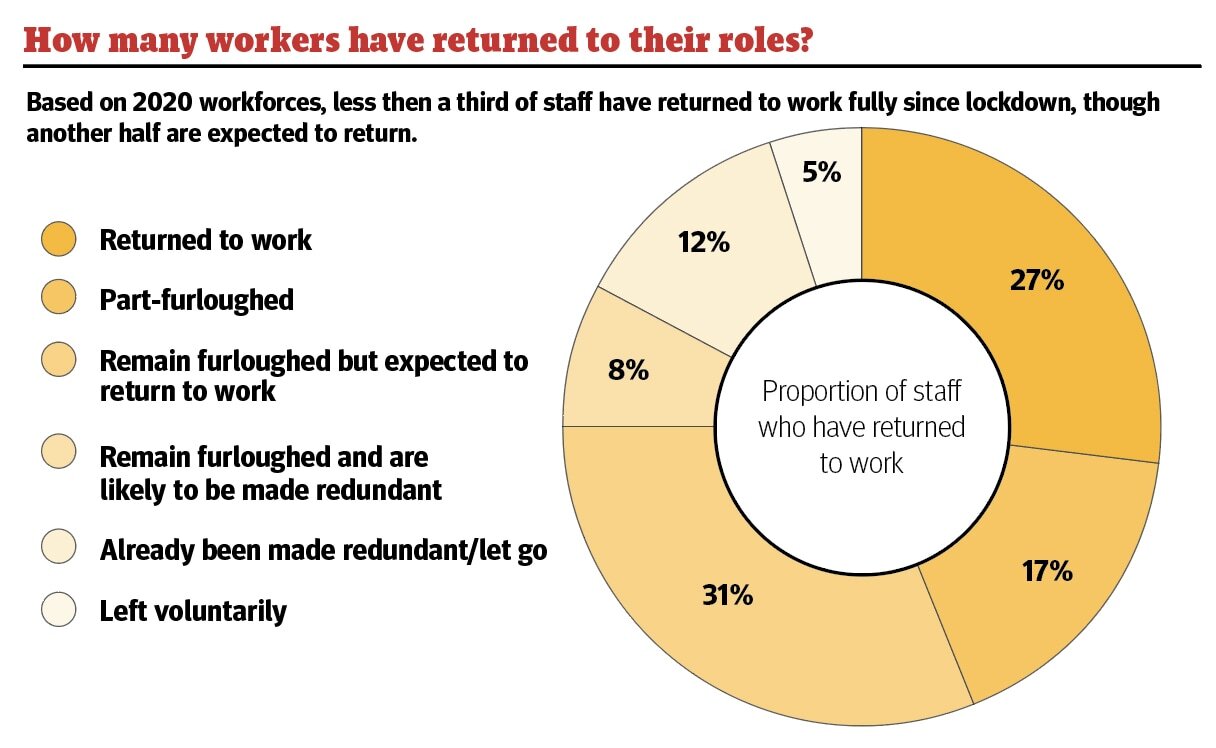

When faced with the fact that only 27% of hospitality staff have returned to work after furlough, a staffing crisis is a given. Glynn Davis analyses The Caterer’s Hospitality Business Leaders Survey 2021, compiled by CGA, to discover what the sector plans to do about it.

Of the business challenges presented by Covid-19 and Brexit, the most concerning is the chronic shortage of staff within the sector.

According to The Caterer’s Hospitality Business Leaders Survey 2021, compiled by CGA, labour shortages are the number one concern for leaders, with 61% referencing it as an issue (this rises to 91% for independent restaurant chains).

Melvin Gold, managing director of Melvin Gold Consulting, said: “It’s very difficult to know what has been caused by Brexit and what’s caused by Covid-19.” What is also muddying the waters is the ongoing furlough situation. Based on 2020 workforces, only 27% of staff have returned to work fully since lockdown. Although this figure will be boosted by the 31% who are predicted to return to work, it still leaves many questions about the whereabouts of many former employees and whether they have any intention of returning when furlough ends.

Charlie Mitchell, research and insight director at CGA, says: “There is anecdotal evidence and data that people on furlough for a long time have used this period to look at other job prospects. For many reasons they might not have seen hospitality as the best career.”

This might well be the case, but Gold is still puzzled. He says UKHospitality has stated that around 10,000 businesses have closed, and many retailers have also shut up shop, so where have all these workers gone? There will, however, be a cohort who have returned to EU countries as a result of Covid-19 and – possibly because of entry issues caused by Brexit – will not be returning.

Under these conditions it is not surprising that the survey found that 96% of leaders expected they would need to recruit later in the year when levels return to normal. Interestingly, 35% of this number expected that they would need to recruit to a greater extent than previously.

For Peter Martin, founder of Peach 20/20, business closures will ultimately make things easier for recruitment: “We’ll have a smaller industry, which will help with reducing competition and having more people available,” he said. But even with this he predicts some poaching of staff and a rise in agency staffing costs.

This high likelihood of costs being added to businesses is reflected in the survey finding that 52% of leaders were concerned about living wage levels. It is clear that wages are intrinsically linked to staffing levels, and so fewer available people will inevitably put pressure on wages. To counter this during Covid-19, Gold said that some smart working practices were being introduced into many hotels.

“Not before time they have embraced technology, including QR codes and online check-in and check-out. There is a general view from the hotel industry that in order to have profitability there is a need for elements of efficiency to come into play. Covid-19 was the catalyst for this change. The pressure on pay will be offset by technology and new working practices,” he explained.

One potential route to broadening the talent pool is to diversify the target universe. Although the survey found that 56% of leaders had a plan to address diversity in their business, this means 46% do not – with 23% saying it was something they were looking into.

“A lot more needs to be done in this area and the sector needs to think about it a lot more,” said Martin, who can cite one positive example involving Greene King. The pub giant has struck a partnership with Landmarks Specialist College to provide 16- to 24-year-olds with learning difficulties and disabilities the opportunity to develop employment life skills as they enter the hospitality industry.

Gold agreed that as a major employer it was very disappointing that much of the industry does not have a diversity plan.

“It’s a sad indictment of the sector,” he said, adding that diversity should not just be about skin colour but should include people with disabilities. On top of this there should also be advancement and promotion opportunities within diversity plans.

Against this background there remains great uncertainty in the market and the forecast for staffing is not good. The survey found 70% of leaders predicted shortages across all roles in their organisations and that 60% think the negative effects of the pandemic on the sector will further dent the industry’s image as an employer of choice.

Gold predicted that there would not be full visibility until we return to more ‘normal times’ and when furlough unwinds, but he has concerns: “Would I want to work for a business that might be forced to close? The industry recognises it needs to set its stall out as a solid sector and employer. The big question facing hospitality is how to attract people.”

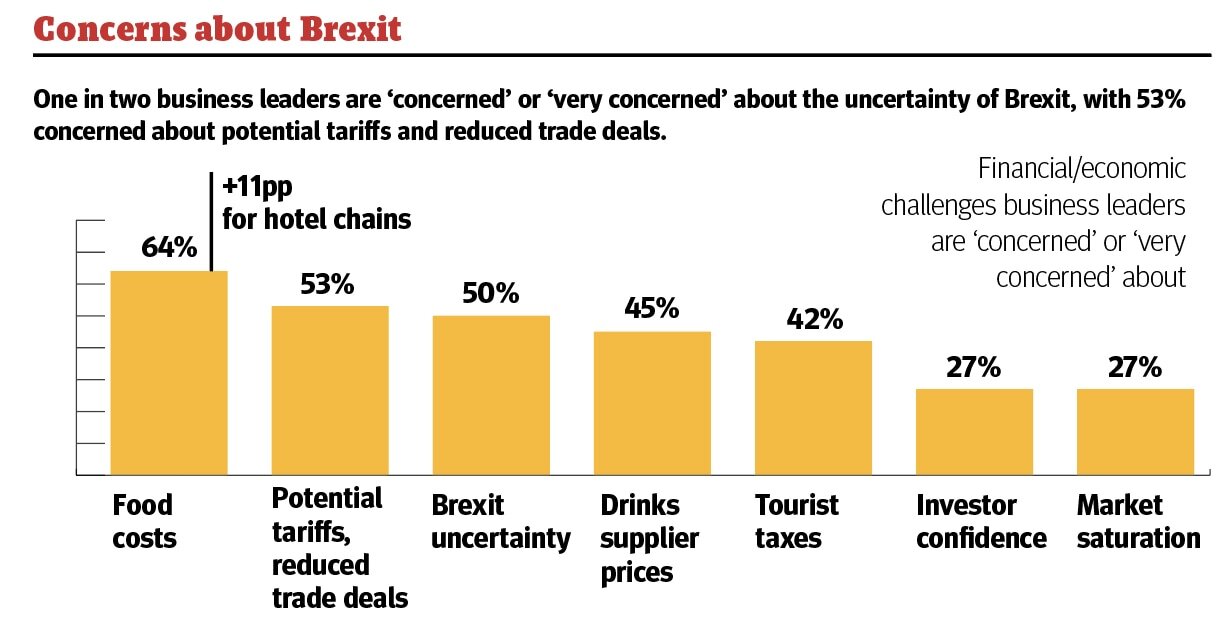

Employee shortages are only one of the effects of Brexit. Of the 48% of business leaders who stated it has had an impact on their business (41% viewed it negatively) in April when the survey was taken, it was food costs that were the main concern for 64% of leaders.

Mitchell said it is only now that the real impact on food costs can be seen: “There had been an expectation of food cost increases, but now we can really see this in some categories.”

Martin suggested the various lockdowns have masked the effect on food costs and Brexit’s disruptive impact on cross-border trade: “Food and drink supply involves agricultural food policy and no one is sure what needs to be done with our homegrown food production if the hospitality industry needs to source more of these foods. Agriculture cannot turn on a sixpence; you’ve got to plan ahead,” explained Martin.

Despite these challenges Gold said that most hoteliers had for some time been looking into their sourcing and the effect Brexit has had on costs and from this they have been adapting accordingly.

Hospitality leaders were also optimistic about the staffing situation, with 54% expressing confidence in their ability to recruit, train and retain their workforce post-Brexit. Within this, 17% even suggest they were ‘very confident’.

Since optimism is relative, this figure might be reflective of the fact the industry has moved out of the dark days of lockdowns, according to Martin, and those leaders surveyed had the benefit of being among the survivors.

“There is also the factor that in surveys people are always more optimistic about their own businesses than they are about the market in general,” he suggested.

Mitchell also pointed to the fact the survey was weighted towards multi-site operators who have, in many cases, been “more financially savvy” and sorted out their balance sheets and debt compared to smaller independents. Many of the latter have been under more pressure, suffered closures and were clearly less optimistic.

What the 54% also highlighted, according to Mitchell, is that leaders of hospitality companies were typically bullish individuals and will characteristically be “up for a challenge”.

Gold agreed: “Leaders have to be optimistic. They have to recognise there are issues and to then find solutions.”

Hospitality Business Leaders Report 2021

The full Hospitality Business Leaders Report is available to The Caterer Gold Club subscribers.

It features analysis of sentiment among leading figures in the industry taken in late April 2021, exploring the future for hospitality, the formats tipped for success, how operators are executing their reopening strategy and where they are prioritising their marketing.

Read the full Hospitality Business Leaders Report

Photo credit: dotshock/shutterstock.com