Spring Statement: ‘missed opportunity’ to help hospitality businesses

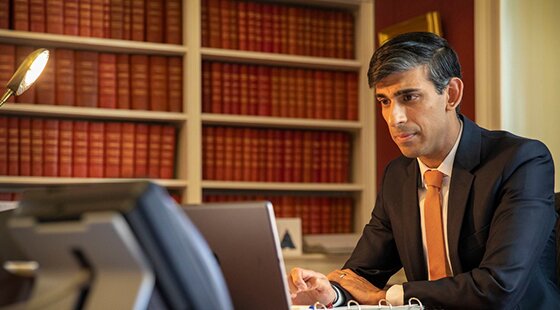

Chancellor Rishi Sunak’s Spring Statement this afternoon has been described as a "missed opportunity" to help hospitality businesses and failed to commit to the hoped-for VAT cut.

Sunak’s statement promised “a stronger, more secure economy” and committed to cut fuel duty by 5p per litre from 6pm tonight until March 2023.

The Statement included a tax plan, to be published later today, to “create conditions for higher growth” with a particular focus on reducing taxes “in a way that is responsible and sustainable”.

From July the employee National Insurance threshold will increase by £3,000, meaning people will be able to earn £12,570 a year without paying income tax or National Insurance.

In two weeks’ time, Employment Allowance will increase to £5,000, a new tax cut worth up to £1,000 per company for 500,000 small businesses.

Sunak announced that the government will consider whether the current tax system including the operation of the apprenticeship levy is doing enough to incentivise businesses to invest in training and will look at reforming R&D tax credits to make them better value for money.

He announced plans to cut tax rates on business investments in the Autumn Budget and to discuss the best way to do this with businesses, while the basic rate of income tax will be cut from 20p to 19p by the end of this Parliament in 2024.

“We will continue to weigh carefully calls for additional public spending. More borrowing is not cost or risk-free,” said Sunak.

He also confirmed that from next month, the 50% year-long discount on business rates up to £110,000 will be available for the retail, hospitality and leisure sectors.

During the pandemic, hospitality premises received a 100% business rates discount during 2020/21 and for the first three months of 2021/22, with a 66% relief for the remaining nine months up to a total value of £2m per business.

However, from 1 April, this will be replaced by the smaller 50% relief. Altus Group said the lower discount and much smaller cap on help will see the cost of the support halve from £5.76b during 2021/22 to £2.66b for 2022/23, costing high street businesses an extra £3.1b in tax.

The hospitality industry had been putting pressure on the chancellor to keep VAT at 12.5%, due to return to 20% from April, to help businesses struggling with rising costs and food and energy prices.

An inquiry by a group of MPs recommended a freeze in the tax to encourage businesses to offer lower prices and help them recover, while trade bodies including UKHospitality, the British Institute of Innkeeping (BII), the British Beer & Pub Association (BBPA) and Hospitality Ulster said the reduced VAT extension was "imperative" as venues were having to cut trading hours and raise prices to combat spiralling costs.

UKHospitality chief executive Kate Nicholls said: “For many businesses, the removal of the lifeline of a lower rate of VAT might prove fatal. For a heavily, disproportionately taxed sector a return to 20% dashes the hopes that many businesses could begin to recoup some of the losses of the last two years.

“Operators in the sector – large and small – have several hurdles to clear on the road to recovery: huge accumulated debts; unprecedented rising costs for energy and raw goods; a chronic shortage of staff; and a fundamentally unfair and crippling business rates regime we’re desperate to see reformed.

“Locking in VAT at 12.5% would have given hospitality businesses a major boost, and helped the sector in its ambition to lead the UK back to post-Covid prosperity. As it is, thousands of jobs could be lost, the UK will remain uncompetitive versus international rivals, and already hard-pressed consumers in the midst of a cost-of-living crisis will see price rises in their favourite pubs, bars and restaurants, further fuelling inflation."

However, she added that the proposed reform of the apprenticeship levy and National Insurance threshold increase would be welcomed.

Chris Jowsey, chief executive of pub group Admiral Taverns, said: “I’m disappointed the Chancellor has not announced any new support measures for the pub and brewing industries, which together contribute £26.2b to the UK economy each year. Industry trading volumes have not yet returned to pre-pandemic levels and its vital that the government continue to invest in the sector at this critical juncture as support measures come to an end. Our licensees worked incredibly hard to sustain community pubs throughout the pandemic and yet their businesses are now being put at risk by further rising costs such as energy and food prices.

"If community pubs up and down the country are to keep their doors open and, in doing so, maintain the jobs of the 936,000 people employed in these industries, I urge the government to consider further support through the immediate introduction of lower beer duty (currently planned for 2023) and much needed reform of business rates.”

Photo: Flickr / HM Treasury