Tipping laws: How operators are handling the new rules

With new laws to ensure staff receive 100% of tips coming into play, The Caterer’s Tipping and Payments Summit discussed how to ensure operators are following the rules

The historic inclusion of service charge on bills and exactly how some businesses have used that money has, until recently, remained a murky area. But that’s about to change. From October businesses will be legally required to ensure all tips go to staff and they must also have transparent processes in place to ensure the money is distributed fairly and promptly. Operators and experts in the area shared their expertise at The Caterer’s Tipping and Payments summit, sponsored by Fourth and Square.

For Chantelle Nicholson, chef owner of Apricity in London, the changes align with how her business already operates. In fact, Nicholson initially decided not to include service charge when she opened her Mayfair restaurant in 2022. Instead, Apricity incorporated the funds that would have been raised through service charge into the overall cost of food and drink.

The chef explains: “As someone who has been in the industry in London for almost 20 years, tipping was always something that made me a little bit uncomfortable about how it was used.”

Last June she decided to introduce a 5% service charge, as an extra reward for staff. The system is already compliant with the new laws: the tronc is overseen by the chef and restaurant manager, and it has buy-in from staff on how monies are distributed.

Nicholson adds: “Because we knew this was coming, everything was set up in that structure to start with. I feel that we meet in the middle, so the staff have a higher base [salary] but they also have a top-up that comes each month. And in a sense, that’s what it’s supposed to be. It’s a bonus – it’s not being used to top-up salaries.”

Clearly written polices detail the distribution of tips, with money shared out based on service, position and performance, in a way that was decided by the team. Nicholson adds: “I think for us, the transparency piece is key, which is something I never had in the past.”

Sharing out a proportion of service charge based on performance also acts as an incentive, she says: “That was all agreed by consensus to start with. There’s always going to be an element of subjectivity, because we’re talking about something that isn’t black and white, necessarily. But I think you can get to a point where the majority agrees it is [fair and] objective, and that’s the sweet spot.”

Overall, she’s positive about the legislation. “As employers, it’s about knowing about all the boxes we need to tick. Even though we may have the right intention, it’s making sure we have all the T’s crossed and the I’s dotted.”

However, one sticking point is the lack of flexibility within the legislation to stagger the distribution of tips over a longer period, so employees are evenly renumerated throughout the year. Under the new rules, all tips must be paid to staff by the end of the month after they are received.

Nicholson says: “I think the inability to smooth it out over the year is going to be really tricky for our industry. If the objective was to make it more fair for workers, I think that’s one thing that has potentially backfired.”

The right systems

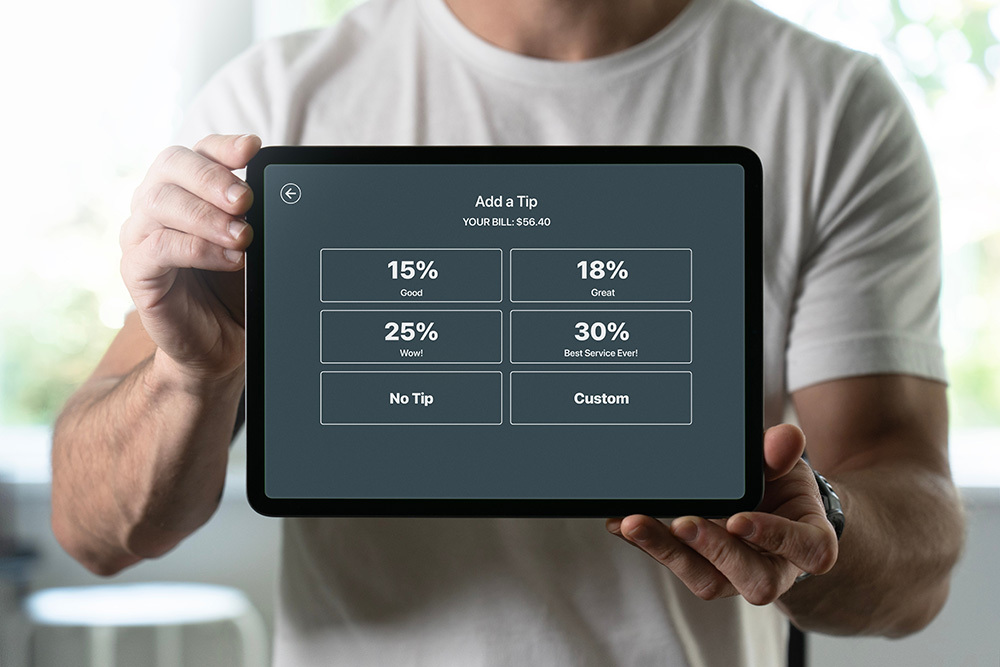

The seasonal nature of tipping is something payments platform Square has highlighted in a recent analysis of its data.

“Last year May and December came out as the months with the most tips,” says Samina Hussain-Letch, executive director of Square UK. “It was the start of summer and sporting events and then the festive season.”

Interestingly, time of day can have an impact on the amount tipped. “The most popular time for tipping is 9.31pm exactly, which suggests that Brits feel more generousover dinner than they are over lunch and breakfast when it comes to tipping.”

Hussain-Letch acknowledges that operators are already facing a number of challenges and cost pressures, adding that technology could provide greater support. She says: “It’s really important to look at technology solutions that can help business owners do more with less, and we’re encouraging sellers in the restaurant industry to consider features such as automated inventory management, online ordering systems, self-service ordering from the table through QR codes, delivery through third parties – the list goes on.”

Alison Barlow, product manager at workforce management company Fourth, agrees: “There’s been an awful lot of changes, particularly affecting the hospitality industry: the national living wage increasing, the irregular hour worker holiday calculations and now the tip legislation. But it’s a fundamental responsibility of being an employer that we have to keep up with these legislation changes. Luckily, there is a lot of information out there and it’s making it a little easier for operators to keep up.

“We’re getting so many queries about our automated systems, which take it all out of the hands of the operators and take away the administration. The system distributes according to the tronc points and it’s really simple and plain.”

Whatever approach operators use to navigate these complexities, a key piece of advice is not to be complacent, says Peter Davies, managing director at WMT Troncmaster Services: “What the legislation does is formalise what until now have often been quite informal arrangements, but now there is the possibility of enforcement and legal action, which by and large didn’t exist before,” he says.

“There will be many businesses that will say, ‘we have always given all of the money to our staff, so this doesn’t affect us, does it?’ And the answer is it does, because of the requirement for records, because of things like the written policy and because of the rights that employees will have to a greater degree of information. These are all new obligations, which are over and above giving all the money to the team.”

With just a matter of months to go, now is the time for operators make sure they aren’t hit with an unexpected bill themselves for non-compliance when the new laws come into force.

The new tipping laws and your legal requirements

John Guthrie, employment policy adviser at UKHospitality, and Martin Pratt, partner at law firm RWK Goodman, outline what the forthcoming rules on handling tips and service charge will mean for operators.

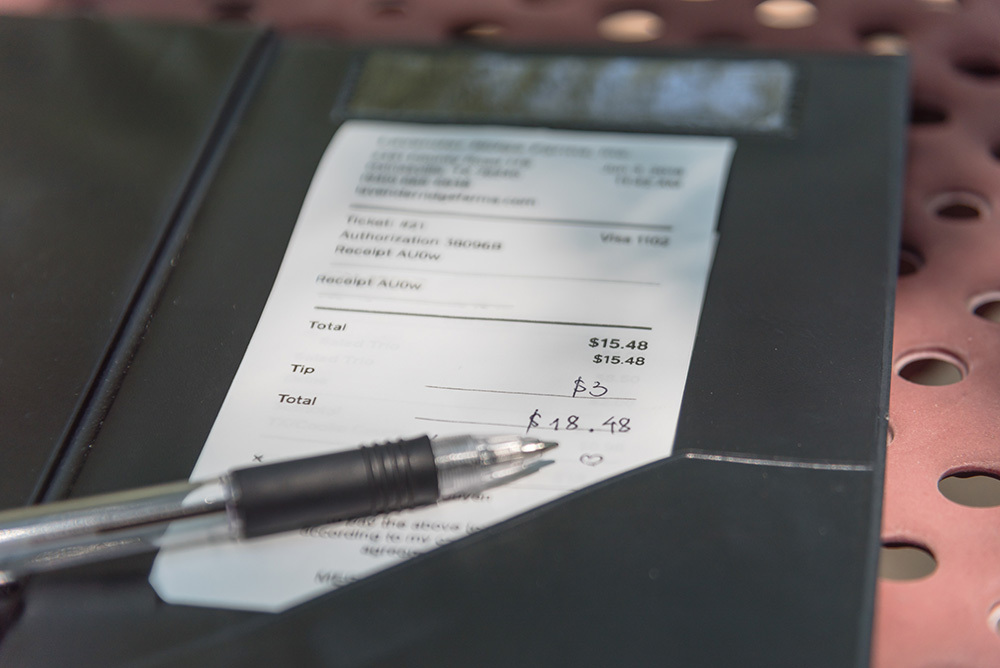

The Employment (Allocation of Tips) Act 2023 legislation comes into effect on 1 October and an accompanying code of practice sets out how businesses should interpret the law. It will mean 100% of tips go to employees, with only deductions for tax allowed.

“This is the core purpose of the act,” says Guthrie.

Tips must be paid to employees by the end of the month following when they were received; they must be paid to employees at the place of work where the tip was received; and the distribution of tips must be deemed fair. Agency workers are also entitled to a share of the tips. Businesses must keep records for three years and workers can request to see the value of tips received.

“The code has sought to be light in touch, but the administration and record-keeping obligations will cause a headache for some businesses, and you have to start to tackle them now,” says Guthrie.

Pratt likens the code of practice to the Highway Code. Non-compliance could be “very good evidence that if it gets before an employment tribunal, you have breached the act. Just as a breach of the Highway Code would mean you may be convicted under road traffic legislation,” he says.

On the point about ‘fair’ distribution, he says that can be decided by employers, but crucially it must be transparent and agreed with employees.

“The key thing in the act is not just fairness but transparency. When you’re setting out the criteria for how you’re allocating tips, you’ll need to have a physical or electronic document that sets out how you’re doing it and why,” he says.

An outcome of the legislation is that some businesses may be taken to employment tribunals – although having procedures to resolve any grievances internally could also help avoid disputes escalating.

Efforts by some businesses to replace service charges with other charges may be subject to employment tribunal litigation in the future, he says. “There is a lot in the legislation, which is a framework and needs to be filled in. It’s only in the next few years when we get employment tribunal decisions to allow us to interpret some of the act that we’ll get clarity on a lot of the legislation.”

What operators need to know

The Employment (Allocation of Tips) Act 2023 will introduce new rules around how tips and service charge are managed by employers and distributed to teams.

Its implementation has been delayed for three months until 1 October, but Peter Davies, managing director of WMT Troncmaster Services, has stressed that operators need to prepare now to ensure they are familiar with the breadth of requirements.

The key points of the legislation and code of practice are:

- Employers will be required to pass on 100% of tips and service charge to teams.

- The only tips falling outside the scope of the legislation are those where the employer has no oversight of transaction or distribution.

- All funds must be distributed to employees by the end of the month after which they are received.

- Hospitality operators must have a written policy detailing how tips are accepted and distributed that should be made available to all team members.

- Policies should be agreed with teams and must be ‘fair’.

- Agency workers will have an entitlement to a proportion of tips. Once tips are passed on to the agency that provided the worker, it will have the legal responsibility to ensure monies reach them in full.

- Service charge received at a one site within a group cannot be amalgamated with that generated by another site and can only be shared between employees who worked at that site. However there is scope for those working in a non-public place of business (ie head office) to receive funds.

- Employers must keep records, which employees have the right to view on request (up to one request every three months).

- The act gives staff members and agency workers the right to take complaints about tips to an employment tribunal.

About Square

Square is a proud sponsor of The Caterer’s Tipping and Payment Summit 2024.

As a leader in integrated business solutions for the hospitality industry we recognise how important it is to stay

ahead of changes that can impact how businesses operate.

In supporting this event, which gave businesses the opportunity to discuss how they can effectively comply with the new tipping legislation, our goal was to create a better understanding of tipping culture and make operators aware of some of the tools available to help them manage and grow their business.

For more information, please visit our website squareup.com/gb/en/campaign/big-in-restaurants

About Fourth

As the leading HR and payroll solution provider to the UK hospitality industry, Fourth is proud to sponsor this crucial discussion and is committed to ensuring that the Fourth platform, led by Ali Barlow and her team, meets new legislative requirements.

Fourth’s AI-driven Workforce and Inventory Management Platform empowers you to build loyal teams, overcome tight margins, and deliver exceptional customer service. Fourth proudly serves 15,000 customers across 100,000 sites with 2.5 million users.

To find out more visit uk.fourth.com