Wake-up call: employers must ensure staff who self-isolate don’t lose out on pay

If employees self-isolate but are not ‘sick’, are they cut off from the company sickness payments? Jessica Foster examines their rights.

The problem

We’re encouraging staff to let us know if they have symptoms of Covid-19 or have been in contact with someone that has. However, there is a clear tension between this and their entitlement to be paid. What is the law and how can we make sure we’re doing the right thing?

The law

We are all legally required to stay at home and self-isolate following a positive test result for Covid-19, if we are living with someone or in a support bubble with someone who has tested positive, or if we have been notified by NHS Test and Trace of a need to self-isolate.

Government guidance also recommends staying at home if you are displaying symptoms of Covid-19, or if you are living with someone or in a support bubble with someone displaying symptoms.

Employees who are required to self-isolate but cannot work from home will be entitled to statutory sick pay. Low income employees may also be eligible for the Test and Trace Support Payment if they are unable to work after being told to self-isolate by the Test and Trace app.

Most company sick pay policies only provide sick pay where an employee is “sick”. Therefore, unless the employee is displaying symptoms, it is unlikely they will be eligible.

While most employees are notifying their employer in the above circumstances, there is a clear tension with concerns about lost pay. However, employers have the ability to flex their other policies to address this issue and encourage people to do the right thing.

Expert advice

Generally, where people are not following the rules, it is because they are not displaying any symptoms. They either feel under pressure to continue to work, and avoid disruption to the business, or they’re worried about pay as company sick pay will not apply.

First and foremost, it is important to have clear policies and procedures that are easily accessible, clearly communicated and up to date. They should be tailored to your company and communicated in such a way that people can understand the rationale behind them and why they’re important, and possibly even the consequences of not following them. Ensure that policies are being followed at all levels of the business so that the right message is being filtered down.

Finding ways to incentivise people to do the right thing can also help guide people down the right path. For example, making it clear that annual leave can be taken to ensure people’s take-home pay isn’t affected. Many employees who have not taken annual leave due to furlough will welcome this flexibility. It is, however, important that employees choose to do this and are not compelled.

You may even consider amending your company sick pay policy to provide some form of Covid-19 sick pay when employees need to self-isolate.

To-do checklist

- Have a clear policy that explains the rules, what’s required and procedures to follow. It should be easily accessible, clearly communicated and kept up to date.

- Explain the reasons for the policy and the consequences of non-compliance.

- Check the policy has been understood. This might involve training line managers to speak to their teams and reminding people on a regular basis, in case of any confusion.

- How can you incentivise people to do the right thing? Can you flex your holiday policy to allow people to take time off as annual leave, or introduce a Covid-19 payment?

- Acknowledge when people do the right thing and how important this is to the health and safety of their co-workers, guests or customers, and the business.

Beware

Anyone who unreasonably fails to self-isolate is liable to be fined between £1,000 and £10,000 for repeat offences and serious breaches. Employers are liable to a fine between £1,000 and £10,000 if they knowingly allow such a worker to come into work if they are aware of their requirement to self-isolate.

More guidance can be found on the gov.uk website. Click here for advice on stay at home rules, and click here for sick pay information.

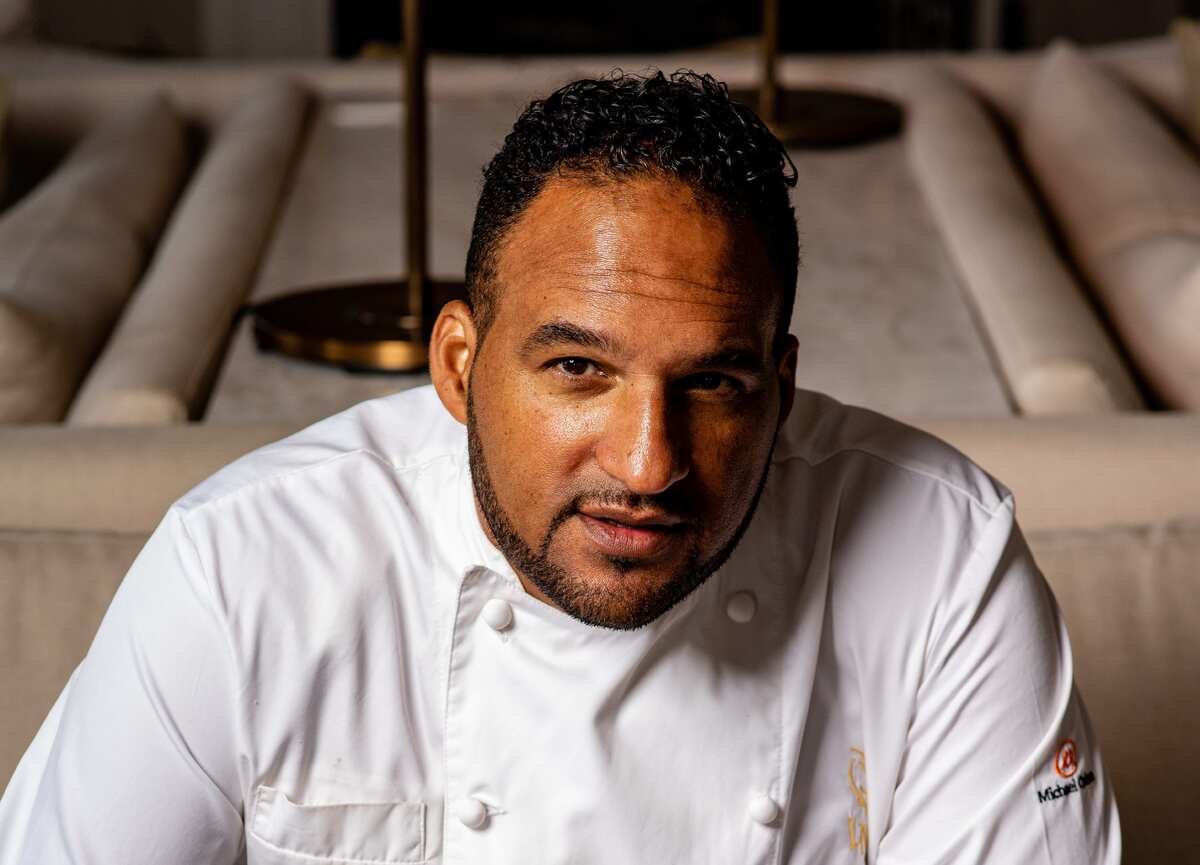

Jessica Foster is legal director at law firm TLT jessica.foster@tltsolicitors.com

Photo: Shutterstock