Rule Britannia: Research reveals that the UK remains an attractive option for both tourists and investors

Despite the uncertainty surrounding Brexit, the UK remains an attractive market for tourists and investors, according to new research. Elly Earls reports

Travellers around the world have regained confidence and gone on more international trips than ever, despite security challenges, according to research by Christie & Co.

The property adviser's new European Hotel Investment Trends 2018: Connectivity, Hospitality & Opportunity report found that international tourist arrivals reached a new record at 1.33 billion globally in 2017, with arrivals to Europe growing by 8.4%, an extraordinary result for such a large and mature region.

European growth was mainly driven by double-digit growth in Southern Europe (up 12.8%), while France and Belgium, recovering from recent security incidents, led the growth in the western part of the continent (up 6.1%).

All destinations in Northern Europe, including the UK, experienced growth, averaging around 5.5%. The report identified the depreciation of the British pound as a key driver of international arrivals to the UK, which increased despite the terrorist attacks in London and Manchester.

"If there continues to be a low exchange rate to the euro and the US dollar, that will continue to drive in-bound growth," says Anna Friedrich, associate director at Christie & Co and author of the report, which also revealed that connectivity and passenger arrivals have a strong, positive correlation, with airport connectivity translating into more overnight stays.

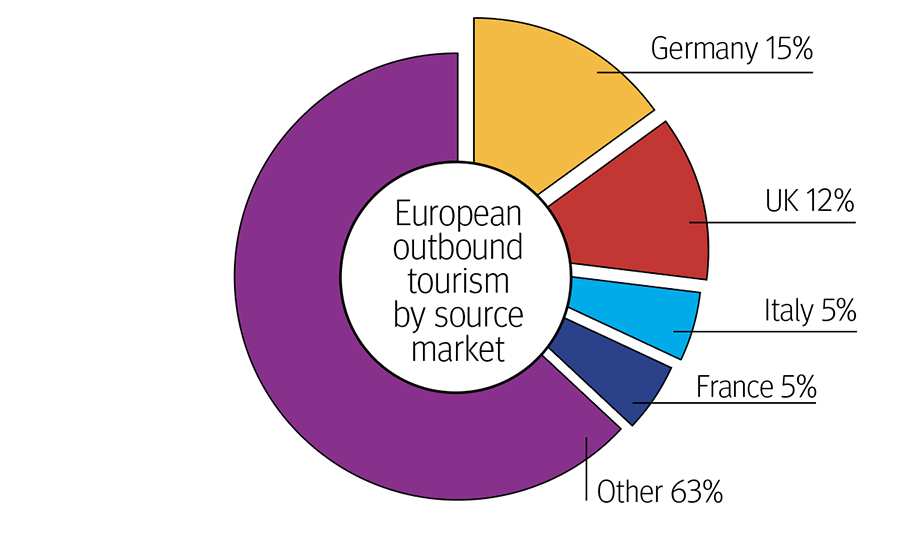

Because of its nature as a feeder market (along with Germany, Italy and France, the UK accounts for almost 40% of the outbound trips made from within Europe) the UK relies heavily on its airport infrastructure to generate overnights.

Investments in Heathrow and Gatwick airports over the next few years could help increase Europe's total airport capacity by 31% from 700 million passengers in 2017 to 920 million by 2028.

A £11.2b third runway at Heathrow was approved by the UK government in summer 2018, with construction expected to be completed by the end of 2025, while the £1.1b expansion of Gatwick's North Terminal, which will include six new departure gates, will be completed by 2023.

Opportunity for supply across Europe

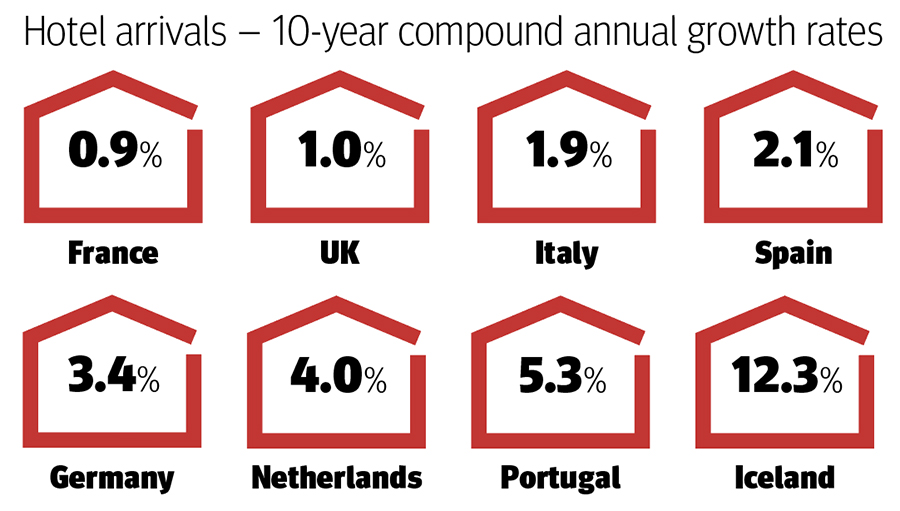

Although hotel arrivals in Europe as a whole increased by 4.7% during 2017, the UK saw only a 1% increase to 72.5 million.

Meanwhile, Germany maintained the top spot (141.1 million), with year-on-year-growth of 4.2%, ahead of France and Spain. Together the three countries accounted for 364 million visitors in 2017, more than half of all arrivals.

The highest year-on-year growth was seen in Iceland (12.1%), followed by the Netherlands, Greece, Portugal, Belgium and Croatia.

When it comes to supply, Italy leads Europe with 2.24 million beds, followed by Spain, Germany, France and the UK correlating with their strong demand, while Portugal demonstrated the highest supply increase since 2016 with 7.7%.

Overnight-to-bed ratios show how supply measures against demand, and all countries apart from Portugal and Austria reported increases, with the highest recorded in Iceland, the Netherlands, Ireland and Spain, showing that there is further opportunity for new supply in these regions.

The report also revealed that while the UK has one of the largest inbound travel markets in recent years, a significant pipeline has materialised and outpaced demand, resulting in balanced levels of supply. Opportunities may become more scarce if the current pipeline (+7% of existing supply) emerges fully, it warned.

Significant demand for UK assets

Overall, investor sentiment has been positive in the UK through 2017 and 2018, with several significant portfolios transacting.

While Swedenâs Pandox ABâs acquisition of the Juryâs Inn portfolio for £680m dominated the end of 2017, 2018 has seen the disposal by Starwood Capital of the 13-strong Principal hotel group for £858m to Foncière des Régions (now Convivio) and Apollo Global Managementâs sale of its 20-strong Holiday Inn and Crowne Plaza portfolio for £742m, among other portfolio transactions.

âThe demand is there â" primarily from European investors,â Friedrich says. âThereâs no lack of demand for the assets in the UK and Iâm expecting that to continue.

âI havenât really seen a focus on a particular segment â" the activity is more based on location. Weâve seen a lot of activity in Manchester, Liverpool and Edinburgh, and Glasgow also has a massive pipeline.â

Looking ahead to 2019, the single biggest thing investors will have their eye on is Brexit, Friedrich adds.

âIt overshadows everything else,â she says. âCosts will also continue to rise and finding ways of reducing costs and finding smarter solutions will be a big opportunity. With Brexit happening, finding labour will also become increasingly challenging, as will securing goods from the continent.â

Other investment hotspots

While the UK, as well as countries like Germany, France and Spain, are already established as attractive hotel investment markets, Christie & Coâs report also identified a number of other European markets that present exciting opportunities for investors in the short to medium term.

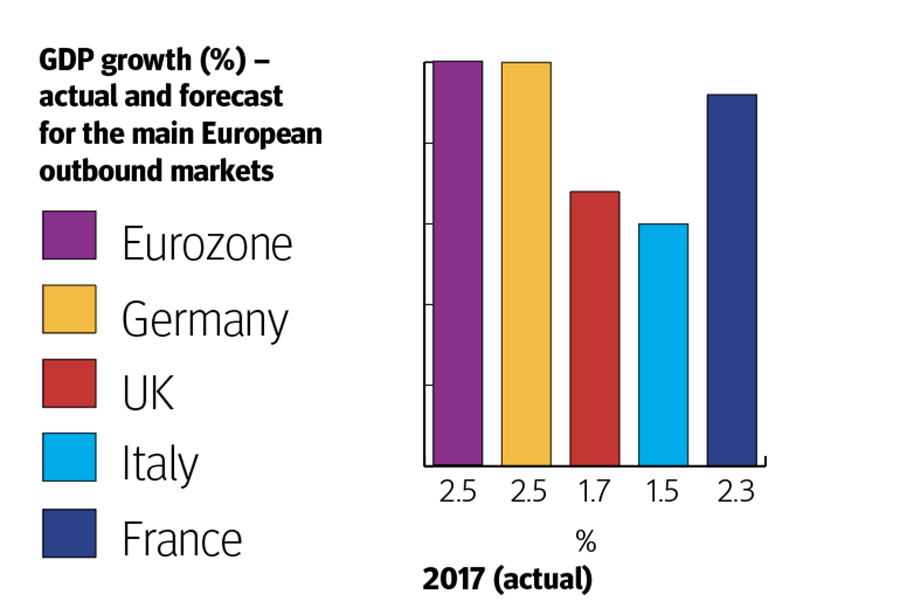

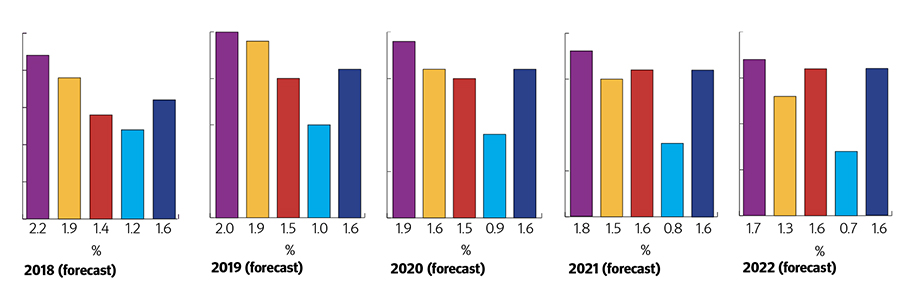

The forecasts were based on the strong positive linear correlation between overnights, GDP and revenue per available room (revpar), which were used to predict revpar performance and demand across Europe in 2020, in line with projected GDP growth.

With demand outgrowing supply, strong projected revpar outlook and relatively low international brand penetration, hotspots for hotel chain development include Croatia, Greece, Ireland, Iceland, Italy and Portugal.

Meanwhile Ireland, the Netherlands, France, Greece and Croatia were identified as hotspots for opportunistic investors. To be considered as an investment hotspot, markets must demonstrate a strong revpar outlook, demand that is projected to outgrow supply, good signs of liquidity and relatively low prices per key.

Yet, despite the uncertainty surrounding Brexit, the UK remains one of the most attractive markets in Europe.

As Friedrich concludes: âIf you were to take away Brexit and make a decision as an investor about whether you would invest in the UK under the current scenario versus would you invest in the UK outside of the EU, I think the answer for both of them is yes.

âSavvy investors will move around that and take more of a long-term view. The UK is the most liquid market in Europe â" that wonât change.â

The Brexit effect

As European outbound markets feed the majority of demand in Europe, it is important to understand how different destinations â" and their hotel performance and value â" can be affected by the events and economic conditions within source markets.

The UK is a case in point. As one of the top-five feeder markets across all 18 destination markets that were analysed in Christie & Coâs report, it accounts for double-digit overnight shares in Iceland (18%), Spain (17%), Portugal (17%), Greece (14%) and Ireland (10%).

So, should the volume of tourism from the UK into Europe decline when the UK leaves the EU in March 2019, this will inevitably affect the performance of tourism-oriented businesses within these countries the most.

Yet, says Friedrich, the impact up until now has not been as significant as expected. âPeople in the UK do tend to travel no matter what â" we saw in 2016, even with the weaker pound sterling, that they still wanted their summer holidays and were willing to spend that money. Itâs really difficult to estimate how big an impact Brexit will have, but Iâm certain there will be an impact.â

Google searches

Google searches are an expression of interest in a particular market, and last yearâs Christie & Co report showed that they can also indicate the growth potential of a given market.

This year, the UK remains the clear leader in terms of share of Google searches, accounting for 35% of total volume. However, Friedrich is keen to caveat this with the fact that the searches analysed are in English.

That said, the UK is a strong market. âItâs the first gateway for Europe for travellers from the US, China and Australia,â Friedrich says. âBut as people become more travel-savvy, they want to explore a bit more of the unknown, so there is an opportunity for the UK to play more towards experiences.â

Thatâs one of the main reasons, she says, that the Nordic countries, which stand out with Sweden, Finland, Denmark and Norway recording high two-year compound annual growth rates (CAGRs), have made such significant progress.

âThe UK might not have dog sledding or the Northern Lights, but it does have a beautiful landscape and marketing that could attract people who have already been to the likes of London and Edinburgh to explore the countryside,â Friedrich says.

The highest two-year CAGR was recorded in Iceland, with 89%. The market tripled its volume of searches between 2015 and 2017, reflecting its increasing appeal.

Portugal and Poland also showed strong growth in Google searches, with 53% and 49% two-year CAGRs. Over the same period, overnights grew by 18% and 22% respectively, two of the highest growth rates over the markets analysed, suggesting a significant increase in interest in these destinations that is translating into greater tourism arrivals.