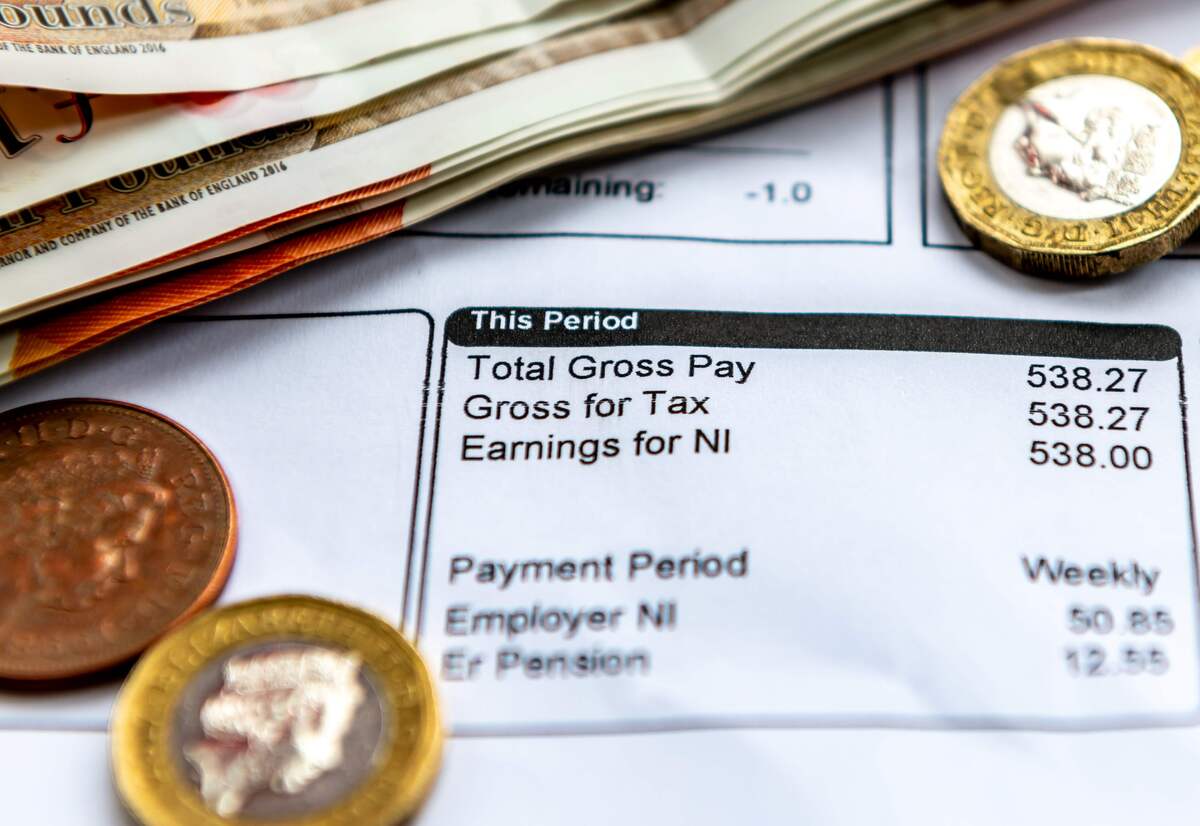

Hospitality faces £1b bill amid employers’ National Insurance hike

UKHospitality calculated nearly 800,000 hospitality staff will be dragged into the new NICs threshold come April.

Some 774,000 hospitality workers will be pulled into the new National Insurance Contributions (NICs) threshold come April, which is expected to cost the industry £1b.

Analysis from UKHospitality revealed a fifth of the hospitality workforce will be affected by the changes to NICs announced in the Budget last year.

Currently, more than 1.2 million hospitality staff are not eligible for employer NICs, but by April this year that number will fall to just over 450,000.

Speaking to The Caterer late last year, Bev King, owner of Z Hotels, said: “There are so many headwinds that make it a really difficult [environment], and everyone will feel it very severely. I can see a lot of businesses that are borderline surviving today are probably going to disappear in the next few years.”

Meanwhile, pub group Young’s said the NICs rise will add £11m to its costs, while hotel group Malmaison and Hotel du Vin warned it would have to add £1.5m to next year’s payroll as a result.

UKHospitality stated the changes will “hit hospitality hardest” as a result of the high proportion of employees working part-time or flexibly.

Businesses are also bracing themselves for an additional £2.4b bill in April due to reduced business rates relief and the rise in minimum wage.

UKHospitality is urging the government to delay these changes to prevent further closures and job losses, while also calling for a new rate of employer NICs at 5%, rather than the 15% for earnings between £5,000 and £9,100 and a lower rate for lower-earning taxpayers working part-time.

Kate Nicholls, chief executive of UKHospitality, said: “The change to employer NICs is one of the most regressive tax changes ever. The scale of this change is unprecedented, bringing three-quarters of a million people into this employer tax for the first time, and the extent of the impact will be enormous.

“This tax is already forcing businesses to abandon investment, change recruitment plans, reduce headcounts and increase prices to cope with these cost increases. At a time when we saw hospitality as the biggest driver of economic growth in November, it’s completely misguided to be punishing a sector that has such growth potential.

She added: “I hope the government can see the devastating impact this will have on businesses, team members and communities, and pause these changes to pursue alternative measures, in partnership with business.”

Her comments come after a series of hospitality businesses announced they will be closing earlier this month, including Café Britaly in London’s Peckham, Tom Kitchin’s Kora in Edinburgh and Björn Frantzén’s Frantzén in London’s Harrods.

Image: Yau Ming Low/Shutterstock