Food chains work fast to get their vegan products to market

The big fast food chains react quickly to public demand for meat alternatives, offering burgers, pizzas and wraps for vegan audiences that are instantly recognisable as true to their brand

A Vegan Food & Living magazine survey from 2019 found that 57% of respondents said they “would never eat at KFC, even if they introduced more vegan options”. But since then, there has been a proliferation of plant-based products entering the fast-food space, from vegan sausage rolls at Greggs to vegan burgers at Burger King. And when KFC officially launched its vegan burger the Imposter in January 2020, the group sold one million in a month.

However, Jo Tivers, head of food and quality at KFC UK & Ireland, acknowledges the product still makes up a small proportion of KFC’s overall sales. “It’s not about making margin or a lot of money from this – it’s really about us staying relevant and having the product that allows us to be fully inclusive,” she explains. “We’re comfortable with it being a small proportion of our sales just as long as we’re catering for everybody.”

KFC decided to prioritise veganising its most popular products first, so its chicken burger was made with a bespoke fillet, developed in partnership with Quorn, and coated in the brand’s famous 11 herbs and spices.

“We did a ton of research and asked people what they wanted: did they want it in a burger form, a Twister wrap form? The big insight was that a lot of people missed eating KFC and there is nothing more iconic than chicken on the bone in a bucket – which is really hard to do in vegan form – or an original recipe fillet burger. So, we decided to go down the fillet burger route just so people could get that taste of KFC,” explains Tivers.

“That’s not to say we aren’t going to do more – I’ve been spending time in the kitchen looking at different products, different formats – all of that is a work in progress. But we’re quite confident that the product we have is the most relevant product out there for people who are choosing not to eat chicken.”

Vegan-novation

Over at another high-street favourite, PizzaExpress, Jane Treasure, food and beverage director, says the chain is constantly looking at new ingredients and working with supply partners to improve its vegan offering. The most popular vegan pizza options at Pizza-Express, which has a vegan menu and customisable options, are the ‘sloppy vegan’, Giardiniera, and the American Jack with jackfruit ‘pepperoni’.

“Our garlic bread with mozzarella is a big seller on the main menu and the garlic bread with vegan mozzarella does equally as well. It’s a good mover for us. And diners can make their dough balls vegan,” adds Treasure. “We want to make sure they can still have that Pizza-Express experience – how miserable would it be if you couldn’t have dough balls?”

But Treasure says it’s important to retain a focus on your core brand values and proposition: “The challenge for us is there are lots of innovations and new technologies coming out – just because our vegan cheese was at the forefront in 2015 or 2016, lots of development has happened since then, so it’s about keeping up to date and not getting distracted,” she says.

“It’s a busy category, but I don’t think you’re going to see vegan sausages on a PizzaExpress pizza. There’s a lot of product in the space, so it’s about keeping the focus within the brand. I think that’s the challenge for everyone.”

Similarly to KFC, Treasure points out that plant-based is a relatively small part of the business, so retaining that focus is a must: “That is the nature of the category. It’s a small but important part of who we are, making sure we offer that choice,” she says.

And it’s not just cities like London where the brands are seeing vegan demand. “We’ve got nearly 540 restaurants the length and breadth of the country,” says Burger King food development director Christian Binney. “And we’ve seen a fantastic response to the [plant-based] menu items we’ve added and they’re growing in popularity and demand. We’ve had great feedback from our guests… that we can offer plant-based and vegan items whether you’re in London city centre, Rotherham, where I’m from, or Inverness in Scotland.”

Tivers says that KFC sees slightly higher sales in university towns and cities such as Brighton, but also in areas catering to populations who don’t eat meat.

Treasure agrees that PizzaExpress doesn’t see massive regional variation in sales across its stores, although its vegan options do perform slightly better on delivery than dine-in. Between January 2020 and 2021, Deliveroo said its overall vegan takeaway orders shot up by 163%.

Properly vegan

Fully certified vegan products don’t just exclude meat from their recipe. They must be segregated from meat products during the preparation and cooking process as well, which can prove challenging for busy operations with limited kitchen facilities.

“It's not so much the development of the product as making sure we can manage it operationally,” points out Tivers. “If or when we look at launching more products, it would have to be under the reassurance that it was properly vegan.”

Burger King’s plant-based Whopper is cooked on the same broiler as its beef patties, but despite this PETA is happy to recommend the product as no animal-derived ingredients are used to make the burgers. Both Burger King and PizzaExpress have temporarily turned sites ‘plant-based’ to market their vegan offerings– although Binney says he doesn’t think the brand has come to the point yet where a dedicated vegan Burger King branch would be on the cards.

“We’ve also got to realise that we’ve got limited space in our kitchens so we can’t just keep expanding constantly – we’ve got to balance out our operations,” he says. “We’re just really looking for standout innovations and it’s got to have something special – we’ve got standards that we need to meet to come onto our menu.”

Those standards include Burger King’s policy of no added preservatives, colours or flavourings, which all menu items have to meet, whether they’re plant-based or not. Binney says it isn’t difficult to align those standards with meat alternatives, “it just needs a lot of work”.

“Yes, it causes challenges, but there’s ways around it,” he continues. “Food science is a well-developed field and there are always new technologies coming into play which can help reduce things like preservatives in food. We’ve got a really clean menu now, which is something we’re really proud of. We just need to make sure that anything new coming into it meets those same strict criteria.”

Tivers agrees that ‘clean label’ meat alternatives has been a priority for KFC. “Quite a few meat alternatives contain titanium dioxide to make them look more white, but we have strictly stayed clear of that because we just don’t think it’s necessary to add ingredients like that into our food,” she says. “There’s no excuse to start adding a load of chemicals.”

When it comes to nutrition, KFC’s vegan burger contains 16.4g of protein compared to its meaty Zinger Burger, which contains 25.8g. The vegan burger is made from a Quorn fillet, a fermented mycoprotein, combined with KFC’s herb and spice coating.

“We looked at so many burgers and we ended up working with Quorn because they were the best out there,” says Tivers. KFC has also committed to net zero by 2040 and she adds that the group’s vegan and meat free menu items have a role in driving that.

Peak plant?

Statistics from market research firm Kantar state that spend growth in the chilled meat-free market slowed last summer, along with Beyond Meat’s fall in share price, as spelling ‘the end’ of plant-based meats. Market commentators blamed poor quality products for putting off consumers. For the year to 27 November 2022, sales grew 4.6% compared to 2021 and 21.1% compared to 2020.

Binney doesn’t necessarily agree that we’ve already reached peak plant meat. “It’s a really exciting area… there are so many new products coming through,” he says. “There are a lot of players that have entered this market over the last three or four years… there are areas that are really advanced technologically, and there are areas where people are still looking to advance in terms of proteins, so that’s still very new.” However, he adds that lab-grown meat is “still a bit too futuristic for me at the moment”.

And unlike supermarket plant-based meat alternatives, fast-food restaurants don’t carry the same higher prices. A vegan burger at KFC is the same price as a fillet burger, there’s no difference between the vegan and their non-vegan pizza equivalents at PizzaExpress, and it’s the same at Burger King. Welcome news to vegans and flexitarians alike during a cost of living crisis.

Plants equals pounds

The success of Gregg’s vegan sausage roll has been widely reported, boosting sales by 15.1% in the first 19 weeks of 2019 after it launched, and quickly making it one of the business’ five bestselling items. The launch was so successful, the chain now has vegan toasties, baguettes and doughnuts on offer.

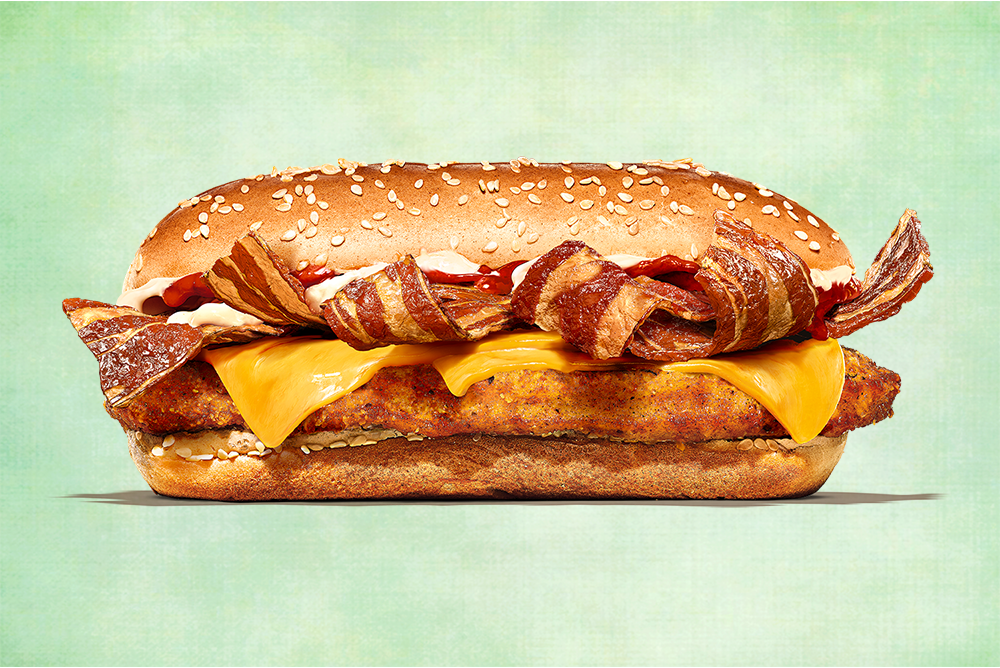

Meanwhile, Burger King UK reported sales of £211.7m for 2021, with a 68% increase in revenues, which it partly attributed to the expansion of its meat-free options such as the plant-based Whopper burger and Vegan Royale, which it launched in 2019 and 2021 respectively. Last year it also launched vegan nuggets, and for this Veganuary it’s launched a plant-based ‘Bakon King’ range as part of its commitment to offer a 50% meat-free menu by 2030.

KFC saw a similar welcome for its vegan burger the Imposter, with sales of the product 500% above what would be expected for a product launch when it was trialled in 2019, selling out within four days. When it was rolled out nationwide in January 2020, the group sold one million in a month.