How hospitality businesses can make the most of customer data

Technology has been vital in keeping restaurants afloat during the pandemic, from online booking systems to order and pay apps. With a whole world of customer data being created, how can operators make best use of this information? Glynn Davis reports.

Hospitality businesses have traditionally been led by great instinctive operators, of which many have impressively risen through the ranks. Starting out working behind the bar or in kitchen roles, they have moved on to ultimately take up chief executive positions or found their own businesses.

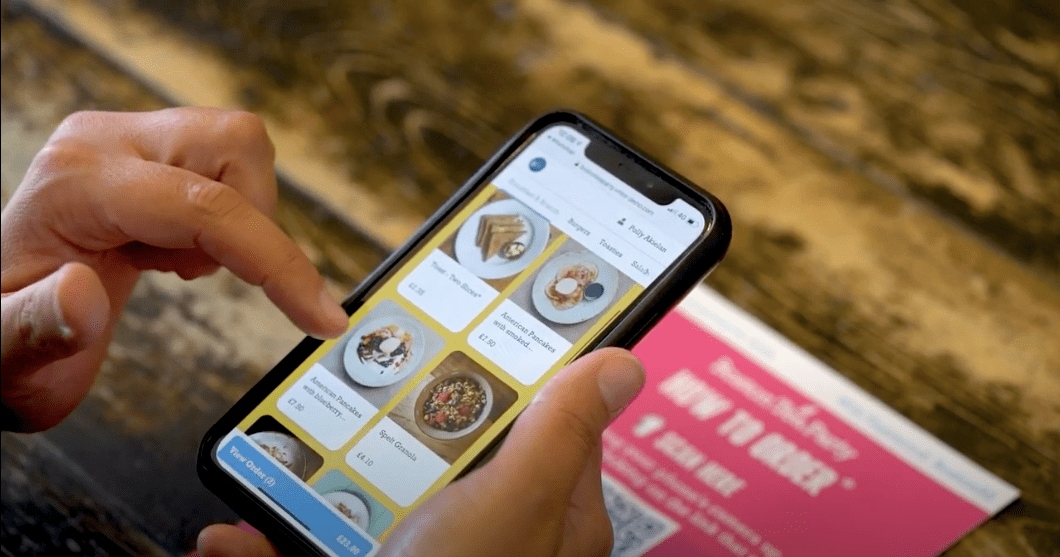

They have been wholly focused on giving a great customer experience and, although this remains vitally important, the rules of the hospitality game are changing. Covid-19 has given the industry a great big shot of data in the arm as it has been forced to adopt new channels such as online ordering, click and collect, and order and pay at table. Hospitality leaders now have to be equally comfortable with segmentation of data as they are with segmenting an orange.

Al Henderson, chief sales officer at Eagle Eye, says: “Unlike retail, hospitality has not been multichannel. There has been no e-commerce component, it has only been about restaurants – so data has not been part of the equation. But when you bring in other channels, we see a fascinating new world for hospitality that has not really seen the benefits of data before.”

We see a fascinating new world for hospitality that has not really seen the benefits of data before

He cites Pret A Manger as a great example of a company where data did not previously play a starring role. With the launch of its coffee subscription scheme, built by Eagle Eye, it has come to recognise its value and is accumulating behaviour data on its customers – including locations they’ve visited, the day of the week, times and purchases made. “This is providing them with a vehicle from which to send out targeted emails.”

Sarah Venning, chief information and transformation officer at Pret A Manger, says: “Data has shown us what’s important regionally, and we’ve seen orders taken later in the day, so we’re doing a dinner proposition. We’re not binning gut instinct, but we see data as absolutely fundamental to our strategy and decision-making.”

We see data as absolutely fundamental to our strategy and decision-making

She has revealed the company is looking to create a joined-up customer experience that involves bringing all its channels – the shops, order ahead, delivery and subscriptions – together this year. One platform will be home to the data and drive the multichannel customer experience.

Know your customer

For Joel Robinson, digital and technology director at Azzurri Group – which comprises the Zizzi, Ask Italian and Coco di Mama brands – the creation of a single view of the customer and transactions is critical to being able to maximise the value of the data in the business (see panel). This is becoming increasingly important as sources of data grow to encompass click and collect, data from websites, mailing databases, order and pay at table, bookings online and voucher downloads.

“We will look for the best partners and plug them into the platform,” he says. One of these partners is Wireless Social, which provides the WiFi infrastructure in Azzurri outlets, collecting a source of rich data on in-restaurant customer behaviour.

The newly developed Hedgehog function within the Wireless Social suite enables relevant offers and vouchers to be sent in real-time to customers when they are in the operator’s venues. For the likes of Azzurri, this can be plugged directly into its order and pay solution, making redemptions fully trackable.

Julian Ross, chief executive of Wireless Social, says customers either log into the network through the operators’ own front-end or through social media platforms such as Facebook. The latter provides much more data – beyond the core of time visited, site location and dwell times – including their interests and activity on these social media platforms. At the moment, 54% log in through social media and the number is growing.

For Robinson the long-term roadmap is to “build more sophisticated approaches to marketing, such as using the Facebook log-in data to help target smaller and smaller segments” and to inform its marketing campaigns. He also receives valuable data insights from Wireless Social that could include nuggets like identifying that 2% of customers account for a hefty 25% of visits.

Such information is fundamental to the approach taken by Victoria Searl, founder of Datahawks, who explains that the new channels of hospitality businesses are throwing out lots of data, but restaurants simply don’t know what to do with it. To help them, she has developed an ‘acquisition, conversion, retention’ strategy, with the most valuable customers placed at the heart of the proposition and fundamental to ongoing marketing activities.

“Companies need to get to know these customers. Every single client has a most common group that equals 80% of their customer base, but they never account for 80% of the spend. For one operator, 37% of spend came from just 1% of its customers – and they were not in the 80% grouping,” she explains.

The focus should be on identifying these valuable customers through ‘proof of presence’ in venues and online – via the likes of WiFi log-ins – and targeting them so they are looked after and therefore continue to be loyal to the organisation. “To identify them, companies need to interrogate the data and enhance it with bought-in data, such as that which shows where else they spend time,” suggests Searl.

The bright side of the pandemic

Building such detailed profiles is very different from the basic data previously held, according to Henderson, who says it consisted of merely defining the customer as active, inactive or lapsed. He suggests Covid-19 has presented an opportunity for hospitality companies to build up knowledge on their customers.

“When GDPR rules came in, some companies, including JD Wetherspoon, deleted their entire customer databases. There has been an opportunity to gather more opt-in data during Covid-19 [helped by track and trace initiatives] and to understand the customer better,” suggests Henderson.

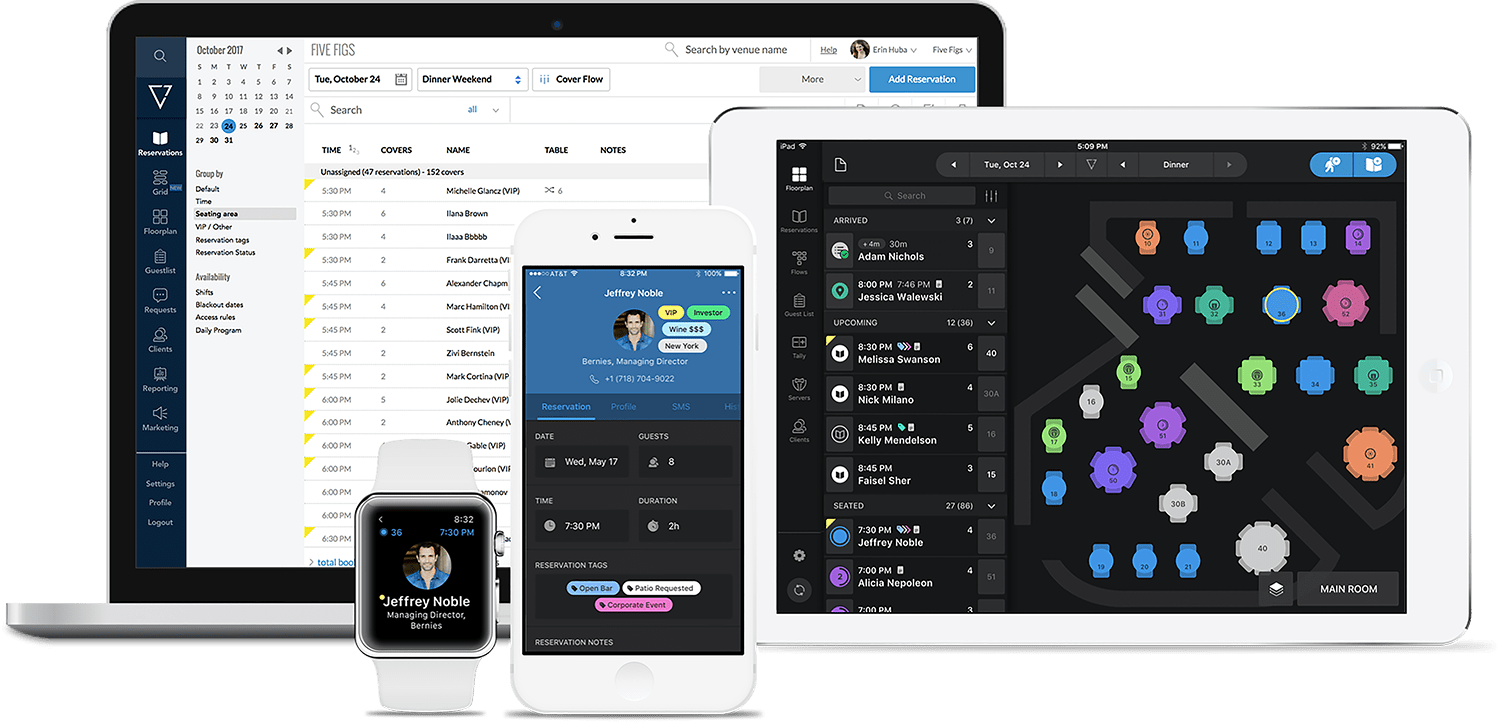

As data becomes more valuable to hospitality organisations, he says the debate will rage about owned channels, where the operator owns the data, versus the delivery and booking aggregators, who maintain ownership of the customer data. This is a vitally important distinction, according to Danilo Mangano, general manager of Europe for SevenRooms, who says: “Compared to other booking platforms, we’re not consumer-facing. It’s a huge difference as we give restaurants full ownership of the data.”

Before Covid-19, SevenRooms focused purely on in-restaurant solutions, such as bookings, managing customer flow in dining rooms, reviews and marketing tools. But this has since been expanded to include online ordering and order- and pay-at-table functionality. Its clients have adopted this broader portfolio and the richer data set it is able to generate.

For instance, SevenRooms has worked with Corbin & King and Hide in London’s Mayfair to target customers with pre-prepared dishes and meal kits online. “We’ve worked with lots of independents like Hide to target specific guests with meal kits using the preferences that had previously been collected and their dietary requirements,” Mangano says, adding that Inception Group did a similar thing with drinks kits.

Mangano says these extra data points sourced from across channels will prove particularly useful when restaurants reopen, because the new customers acquired online can be targeted with offers to visit the dining rooms. “This data will be very valuable because restaurants could, say, take the most popular appetiser online and bring it in as a promotion when they reopen,” he suggests.

Better, faster

Data is not exclusively used for the personalisation of marketing communications – it can also help with improving the efficiency of restaurant operations. Yo! has been able to benefit massively from the data generated from its partnership with Vita Mojo, through a solution encompassing order and pay, click and collect, self-serve kiosks and back-of-house operations.

Nick Liddle, commercial director at Vita Mojo, says it had little visibility of what items sold on its conveyor belts and wastage was around 10%. “The order- and pay-at-table solution goes straight to the kitchen and the conveyor belt is automated to stop at the relevant customer with their ordered items. This gives them 100% more data, whereby they know all the orders, all the customers and have cut wastage.”

It has also improved labour efficiencies by having time-stamped food and seeing how long items take to produce. From this it is possible to redeploy employees from back-of-house or point-of-sale to instead work as floor hosts.

The future

The next steps for hospitality data could involve the Internet of Things (IoT) and connected devices. This will ultimately be a great driver of efficiency but hospitality companies will have to be careful they are not swamped by the data.

Siobhan Fagan, IT director at PizzaExpress, recognises the benefits but suggests caution: “You need to use data well and not be drowned by it. We can see connected devices on the horizon, but they are not quite riding over the ridge yet. The challenge is turning the data into valuable insights. With IoT a fridge could provide you with its temperature every 10 seconds, but how do you use that data?”

You need to use data well and not be drowned by it

These are clearly decisions for the future, but a more pressing issue involves the commitment hospitality companies and independent restaurant operators have for embracing data at a more basic level. There is little doubt that the way the industry is progressing, the use of data will become integral to the running of a differentiated and ultimately successful operation.

Five tips from Victoria Searl, founder of Datahawks

- Most businesses do not have even the most basic data and instead focus on vanity data such as ‘likes’ on social media platforms and names on their database. They should reappraise their data collection.

- When restaurants reopen they will be busy, so it’s an ideal time to get people signed up and opting in. 3 . As much as 87% of people are happy to give out data in order to receive a personalised and relevant experience, so restaurants should ask customers questions during sign-up.

- Continue to use order and pay solutions so data can be collected.

- When using feedback platforms, ensure full functionality is used and don’t just rely on them for Net Promoter Scores (NPS).

Data leader – Azzurri Group

Having spent almost 10 years at Sainsbury’s involved with many technology-related initiatives, Joel Robinson, digital and technology director at Azzurri Group, has been working hard to bring some of the grocer’s disciplines to the hospitality chain, whose brands comprise Zizzi, Ask Italian and Coco di Mama.

His efforts have put the group at the forefront of digital adoption within the industry, which he estimates is five years behind the retail sector. His task is helped by him holding the first digital role on the senior management team at Azzurri, which most crucially enables him to bring all the company’s departments closer together.

“It is not a quick fix. It’s about getting rich sources of data into one place and to make sure what comes out the other side, whichever channel the customer is using, is a consistent message. The plumbing is critical to take the industry away from being silo-driven, where nothing is joined up,” he explains.

The biggest investment has been in partnering with Acteol, a client relationship management system, to help create a single customer view across channels. In addition, Robinson is building a single transactional platform, into which he will plug selected key solutions partners that will enhance the group’s developing digital eco-system. These partners include Wireless Social and Vita Mojo.

“Most brands have click and collect solutions, order and pay solutions and others that are not connected. We’re building a single transactional view, so we’ll know how much a customer interacts on click and collect versus delivery, etc. We can then use all the relevant [marketing] communications,” says Robinson.

As he builds out the digital infrastructure at Azzurri Group, Robinson says it has been vital to have buy-in from the board because of the investments and timeframes involved. “Day-to-day business is super easy as it’s all about short-term decisions for quick returns, but digital and IT leaders need to set out decisions for the long-term,” he explains.

Featured photo: 2019 StockStyle/Shutterstock.com