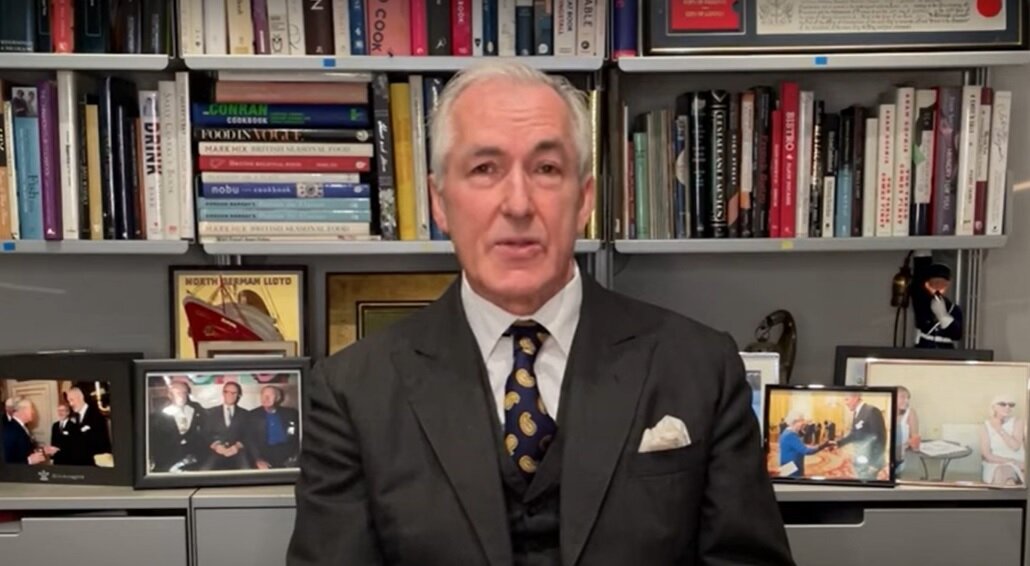

Corbin & King founder looks to reassure amid investor ‘siege’

Corbin & King founder Jeremy King has said his restaurant business is in “rude financial health” and as “busy and profitable as ever”, despite being “under siege” from investor Minor International.

The group’s holding company was put into administration earlier this week by Minor. King has said he plans to buy the holding company out of administration.

In a video posted earlier today, King said: “Please don’t be concerned. This administration is a technical one. It has been invoked by an investor, Minor International, in an attempt to seize control of the company, and it only applies to just one company – the holding company. And in the Corbin & King estate we have 14 other companies that actually run the restaurants. I can assure you that all the restaurants are fully solvent and trading well, and all our staff and suppliers are secure and fully paid. It is very much business as usual.”

The company operates nine restaurants including the Wolseley, the Delaunay, Brasserie Zedel and Colbert.

Thai-based Minor, which acquired its 74% holding in 2017 with a £58m investment, has said £38m of loans and loan guarantees have been in default since May 2020, with "repeated" offers to recapitalise rejected.

“They don’t mention that the conditions attached to that small amount they proposed were in the best interests only of themselves,” said King.

He said: “The only obligation we failed to meet were payments in respect of a £13m loan from Minor themselves. That loan was part of the transaction that saw Minor buy into the company, and Minor told us then that they would be refinancing it. Minor also claimed that we had major liquidity constraints throughout the pandemic. We didn’t. We got through it without any financial support other than the government furlough scheme.

“I’m afraid we do have a fundamental difference of opinion with Minor on how restaurants should be run, and what is the best interest of our customers, staff, landlords and suppliers. I will never change my principles to the detriment to those essential elements of a successful restaurant.”

Dillip Rajakarier, group chief executive of Minor International, said earlier this week: “Contrary to the picture that Mr King is trying to paint, the business is insolvent and is in strong need of further financial support.”

Sky News has reported US fund Knighthead has submitted an offer to Corbin & King's administrators to refinance the £38m of loans owed by the restaurant group to Minor International.

In November, King said relations between the two parties had deteriorated over differences in opinion of what course of action to take through the pandemic. It is understood the restaurateur put forward a proposition to buy the business back from Minor and had a new investor ready to come onboard, but that this proposal was rejected.

Minor purchased most of its stake from private equity firm Graphite Capital, which had invested £21m in the company five years previously.

All Corbin & King restaurants remain open and continue to trade.