Property focus – Bristol

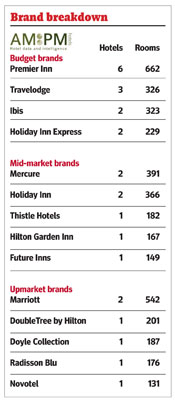

Bristol is the second largest hotel market in the south west of England and currently comprises 64 properties with just over 5,100 rooms, a figure that has

remained relatively unchanged over the last three years. This period of respite followed very strong supply growth between 2006 and 2011, when around 1,300 new rooms entered the market, under brands including Holiday Inn, Ibis, Mercure, Radisson Blu, SACO and Travelodge.

A few modestly sized new serviced apartments, such as the Premier Apartments at Cabot Circus, came onto the market in 2012 and 2013, but this new supply has been offset by the recent closure of the 112-bed Redwood hotel and country club, which is now earmarked for a change of use to a residential retirement village.

The structure of hotel supply in Bristol is heavily polarised towards four-star hotels (more than 40% of rooms) and budget hotels (30% of rooms). Somewhat surprisingly for a destination with such an impressive cultural, heritage, leisure and media reper-toire, the Hotel du Vin is the only real notable boutique/lifestyle hotel in the city.

Hotel investors and developers do appear to have renewed a more serious interest in Bristol during the last year. However, for the time being, a new 175-bed Premier Inn at Lewins Mead - due to open in 2016 - remains the most immediate hotel in the active development pipeline.

Plans to convert the historical Guildhall into the city's first five-star hotel have been approved but have yet to come to fruition. Elsewhere, Bristol Airport has gained consent for a 251- bed hotel, and several mixed-use schemes in the city centre, such as One Bristol and Wapping Wharf, incorporate plans for a new hotel.

Alan Gordon, director, AM:PM

Bristol: transactions

Bristol regularly comes out top of the "best place to live and work" survey in the UK. The greater Bristol area has a population of about one million, so as conurbations go it isn't the largest, but it is dynamic and it is the strongest core city economy outside London, generating £26b, or 2.3% of the GVA for England. Bristol and Bath is recognised as the seventh strongest region in Europe by The FT and is second behind Zurich for economic potential (FDI Intelligence 2014/15).

The pattern of hotel accommodation is much like many other regional cities, in that development over the last seven years has revolved around the budget sector, with Travelodge and Premier Inn expansion as well as a Future Inn. The rest of the sector has been a shuffle of brands around existing stock with

a steady improvement in standards, the latest being the DoubleTree refurbishment.

The preferred option of many operators in recent years has been to convert B grade office space to hotels, though this option has now slipped away as relaxed planning rules on residential conversion and the rush to create more student accommodation has soaked up empty space just at the point where hotel values pass development costs. That leaves new build and there is scope for a top end product. Hotel Du Vin has been on its own for far too long, with only one or two private hotels competing in the sector.

Occupancy is up on the 1.5 million bed nights recorded in 2013. There is definitely activity. We have the Best Western in Clifton under offer and are almost

there on the new hotel at Bristol Airport. Next in line will be the new Arena, a much-vaunted project for proactive Mayor George Ferguson (an architect by profession). He is driving the built environment as a key to economic growth and is right behind tourism; after all, the spend was £1.24b by visitors last year.

Simon Wells, director of hotels agency, Colliers International Corporate demand to rise Bristol is a core UK city and the regional capital of the South West. It is a major business centre and was recently singled out as one of the most economically significant clusters in the UK, forming a 'high-tech and ICT' cluster, boasting companies from hardware and semiconductor manufacture to e-commerce retailers and the creative industries.

The city is an increasingly popular tourist destination, especially for short urban breaks with good retail, leisure and cultural offerings.

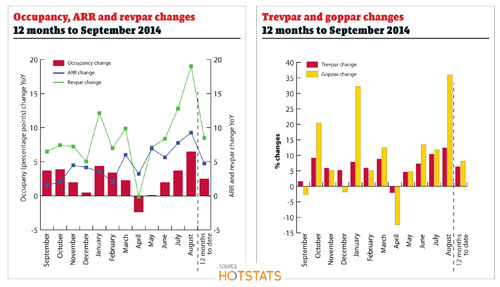

According to data from HotStats, Bristol's hoteliers enjoyed improved trading in the 12 months to August 2014 and all key trading metrics registered growth. Occupancies rose to almost 74% in the 12 months to August - a 2.5% gain over the same period in 2013. ADR saw double digit gains in January and July with a 19% spike in August. Overall, rates averaged £73 over the 12 months to August - an advance of 4.8% over the previous year. This translated into an 8.5% increase in revpar and similar strong goppar growth - goppar shot up by over 30% in August. Bristol is forecast to be one of the most economically successful British cities outside London, according to a report by Capital Economics. Its importance could accelerate as it moves to set up a so-called super-authority to benefit from government plans to devolve power and allow regional cities more control over their finances. There are also plans for a long awaited 12,000-seater indoor arena.

Liz Hall, head of hospitality & leisure research, PwC