How hospitality businesses can integrate fast payments technology into existing systems

While there is plenty of customer payments software on the market, its future lies in integration and ease of use. Glynn Davies discovers what considerations operators need to be taking into account.

Online payments group Stripe recently became Silicon Valley's most prized private company with a valuation of $95b [£68.3b]. The secret of its incredible success boils down to its speed of operation and simplicity of integration into the infrastructures of its growing number of retail clients.

These are the key attributes the hospitality industry requires from its payment systems – so how should businesses navigate the choppy waters of finding a solution that incorporates these critical features as the sector increasingly embraces digital and operates across a growing number of channels? What exactly should a future-proofed payments solution look like?

The coronavirus consequences

Certainly the environment within which restaurants and bars operate has changed dramatically since Covid-19 hit. Alison Vasey, group product director at Zonal, says: "A payment solution that is not just effective but also future-proofed has to offer both operators and end-users flexibility and a seamless experience.

"Prior to the pandemic we were already seeing a change in customer behaviour when it came to paying and using the tech solutions on offer. They now have even higher expectations as mobile order and pay becomes increasingly common."

Thomas Evald, senior vice-president of strategy and business development at Joe & the Juice, agrees: "Safety concerns have accelerated the adoption of digital channels. But once customers see how convenient they are, they stick with them. For example, with the Joe & the Juice app, you only have to enter your card details once, making future orders really easy."

The company is unifying the e-commerce and physical store experiences, whereby customers can pre-order from home or order in-store and pay via the terminal or in-app. "We've created this flexibility by connecting our payment data in the back-end. It lets us connect the best of both worlds to deliver an even better service. It also lets us see the whole picture in one place and evaluate our performance. That's amazing for us," explains Evald.

He adds: "Enhanced transaction safety is a lot easier with a fully integrated payments system. Having a single global interface is unique. Usually, even if you're using one provider, they'll have different interfaces in different markets. Having it all in one dashboard makes management easier and more efficient."

Operators need to ensure their solution provides a seamless experience, which first and foremost will involve integration between a payment solution and the electronic point of sale (EPoS), according to Vasey, who says this is a simple but effective way of increasing speed of service and improving the guest experience.

Come together

Integration can be the real headache of software solutions, including those involving payments. Maxwell Harding, founder and chief executive of Dynamify, which works with major contract catering companies including Elior, Vacherin and Sodexo, says that his solution does not need to be integrated with other systems in order to be usable – it provides a single platform for what would typically be serviced by five separate legacy systems. However, where clients want to continue using existing software, it has an open application programming interface (API), which makes the system easy to integrate with the likes of recipe management systems from Fourth, EPoS such as Kappture, third-party delivery networks such as Uber, food lockers such as Parcel Hive and connected fridges such as Selecta.

Ease of integration is a vital component of the new solution developed by Victor Lugger, co-founder of Big Mamma Group and of payments solution Sunday. He says one of the major problems of payment solutions is that they do not easily connect with the myriad EPoS variations in the market – which all require different APIs to link up.

To date the problem with such solutions is that they have been developed by restaurants or point of sale (PoS) providers but "neither knows how to develop a business to consumer (B2C) payments interface," says Lugger. "The PoS companies create deep, complicated software. We have not done it this way."

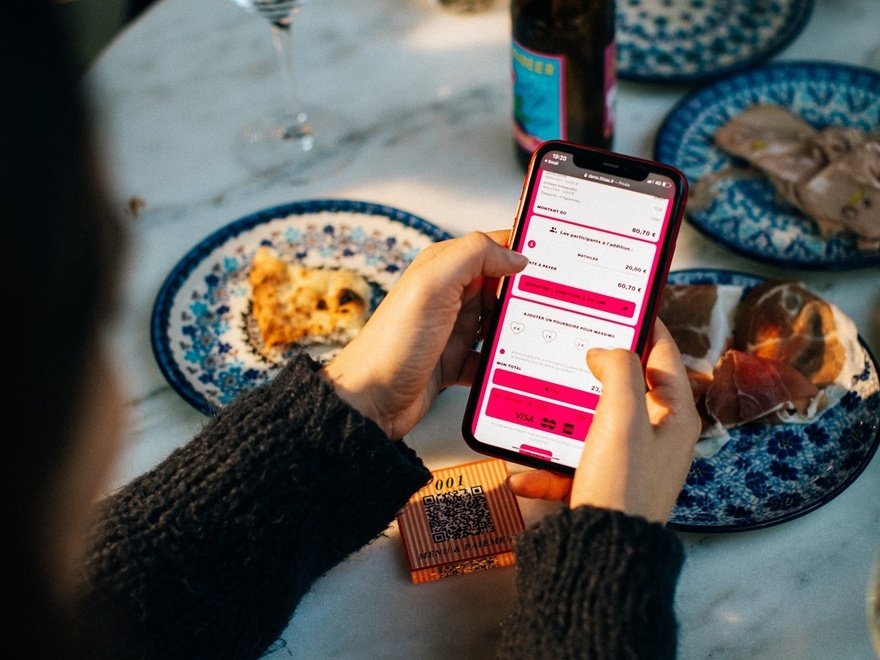

Sunday connects to the restaurant's PoS, from which it takes the bill, which surfaces on the customer's handset once they have scanned the QR code on their table. This code links the bill with the table and that specific customer. The diner can then either enter their card details or pay using the likes of Apple Pay or Google Wallet.

It has been tested within the Big Mamma-operated venues around Europe and has proved sufficiently attractive to many other operators, including JKS Group and Corbin & King, that they are set to roll it out in the UK.

Jeremy King, chief executive of Corbin & King, states: "The end of a meal can so often be make or break in the experience of a restaurant-goer. It doesn't matter how good your welcome is, the quality of the food or how friendly and efficient your service, if the payment becomes protracted or uncomfortable then that's the lingering memory. Your staff will have more time to serve and your customers can more easily show their appreciation – Sunday is a win-win."

If the payment becomes protracted or uncomfortable then that's the lingering memory

Other characteristics of the solution is that it is faster – through its clever technology –and also cheaper than other payment options in the market, as Lugger says restaurants are being "robbed" by the payment processors.

"Every solution on the market is amazingly expensive. Sunday looks simple but it takes great technology combined with a restaurant mindset, not a tech mindset. We're doing what PayPal has done online – being fast, simple and everywhere. But online and offline are very different and we're changing real stuff in real restaurants. PayPal has no clue here," he suggests.

Multi-channel versatility

This is not to say the big tech players are not all over this area. Myles Dawson, UK managing director at Adyen, says pay-at-table functions used to mean downloading an app, but this can now be done through the likes of Facebook Messenger.

"This opens up the digital dining experience to a host of new establishments that don't have their own app-based services. A customer can simply open Facebook Messenger, select the restaurant location and enter the table number. The order is recalled from the cash register and displayed in Messenger. Facebook Messenger has 1.3 billion monthly active users worldwide – just think about opening that digital capability up to your diners," he suggests.

As these new channels, links to platforms and points of interaction are added to businesses and adapt and grow, it becomes increasingly important to have payment systems with great flexibility. Vasey at Zonal suggests consumers now expect to be able to engage with venues and brands through multiple channels and as the tech-enhanced hospitality experience continues to evolve, a fully integrated payment solution – as part of an operator's wider technology ecosystem – will be a crucial element in helping service this demand.

She cites Zonal's work with Rockfish, the seafood restaurant chain that has grown to nine sites since it was founded in 2010, which has reaped the benefits of the flexibility of the provider's integrated payment system.

"Enabling servers to complete transactions at customers' tables without returning to the PoS terminal not only streamlines service but provides front-of-house staff with greater flexibility and the time to improve guest experiences.

"Across hospitality an omni-channel approach is becoming more prevalent. Venues are now having to incorporate mobile order and pay, click and collect and delivery alongside what we would consider a more traditional service, so ensuring your payment solution is fully integrated has never been more crucial," Vasey explains.

The personal touch

This flexibility also extends to the fact restaurants might only require specific elements of a payment solution. Oliver Rowbory, co-founder of Goodtill, says developers are aware that many business owners are simply looking to replace problem areas or faulty software and aren't often looking to opt for the entire package.

"Many PoS providers tailor their packages to the industry and scale of the business and ensure owners pay only for what they use through add-on modules. A café may want mobile ordering, loyalty programmes and insight, while a sports stadium will focus on multi-site support and powerful reporting features to enable the processing of huge amounts of data instantly," he explains.

Rowbory also highlights how payment systems and their surrounding eco-systems accrue data that can then be used to provide a much more personalised experience at the time of customers' ordering and paying the bill.

Harding agrees that payments-related data can be a great value-add: "Software such as Dynamify, which uses AI technology, is able to capture and analyse data in a way operators can't. The software recognises and remembers each users' purchase history, so the app can then prioritise preferred food choices, filter out or warn of any allergens, and, importantly, [offer] bespoke loyalty and reward schemes."

As well as recognising user's dietary preferences, highlighting allergens, and providing live menu updates, which can be pre-ordered in a matter of taps, Catherine Roe, chief executive of Elior UK, says the solution also "supports Elior's mission to minimise food waste. After lunch, users can order surplus-food boxes at discount prices for collection at the end of the day."

It also allows caterers to offer ‘rewards' and ‘giveaways' that customers feel are unique to them. For example, if a caterer wanted to promote seasonal beverages with a giveaway, the software will analyse each individual's purchase history and promote the beverage most of interest to each customer.

Dawson recognises this scenario as Adyen research found 61% of consumers would be more likely to buy from a brand if its loyalty programme was linked to their payment card. "A business can recognise customers at the PoS terminal and create personal interactions, building customer loyalty," he says.

This requirement was very much in mind for bar and restaurant operator New World Trading Company (NWTC), which worked with Zonal to create an integrated mobile payment app incorporating a range of functionality including loyalty and gift cards.

"Without integrating a payment solution with an app-based loyalty programme, such as the one we provided to NWTC, you would be left with a sub-par customer experience and would severely hamper your data capture capabilities," suggests Vasey.

Extracting this data is crucial for operators of all sizes. And it has value not just to provide a personalised customer experience with rewards to loyal guests, but to also gain a deeper understanding of the customer base for strategic decisions and to future-proof the business.

Such considerations highlight how payment solutions fit into a broader eco-system and that care must be taken to ensure that the maximum value is derived from this intricate infrastructure. With the high potential for complexity when choosing solutions, operators should always bear in mind the $95b question – is it fast and simple to integrate?

Case study: Brew York merges its beer prices across systems

Brew York operates a shop, tap room and beer hall in its home city of York, as well as bars in Pocklington and Leeds. Choice is an essential part of the enjoyment of the diverse craft beer scene for many enthusiasts, keen to try beers of different styles, flavour and strengths, but managing that choice and taking payments has been a tough challenge for the company.

The solution has been to link its payments capability to its constantly changing beer list – which is hosted on third-party app Untappd – through Tabology's integrated bar EPoS and mobile ordering solution BarTab & OrderTab.

Wayne Smith, managing director of Brew York, says: "The system we were using previously was very cumbersome; we had to update each beer three times: on the EPoS system as it became available, then on our on-screen menus, and then on our customer ordering app. It was hard to synchronise between them."

The Tabology solution has enabled the bar EPoS system, on-screen menu and app to all draw on a single source of information – the Brew York listings on Untappd.

"Our team now just has to focus on making sure our Untappd listing is correct and up to date, and the rest takes care of itself in our bars – including the all-important payment piece. We just type in the beer name and all the information and imagery is pulled through from Untappd. We can manage it centrally and push the information out to all our venues. We're delighted that it makes the whole process of listing and selling our beers across all our venues simple and straightforward."