Regional hotel property focus: Birmingham

Birmingham, including the airport and NEC but excluding Solihull, is the UK's third largest hotel market with more than 120 properties offering about 13,000 rooms.

As a major city and wider metropolitan area, new supply is a regular feature. As this has only been very modestly offset by hotel closures, net room supply has increased by around 20% over the past five years.

No major new hotels have opened in 2014, but there were five branded openings in 2013 when a Hampton by Hilton, Holiday Inn Express, two Premier Inns and a Staybridge Suites boosted supply by 6% or 700 rooms.

Several active pipeline projects are at an advanced stage, many involving property conversions that benefit from BPRA tax relief rather than entirely new-build construction.

In 2015, around 600 rooms will enter the market, including new serviced apartment/ extended-stay openings by Adagio and Staycity, as well as a four-star hotel at Genting's much anticipated Resorts World.

Looking further ahead, over 500 new rooms are already scheduled to open in 2016 with a Holiday Inn Express under way at Arena Central and a UK debut for Australian hotel brand Park Regis. As yet, no date has been confirmed by Hortons' Estate for a reopening of the iconic Grand hotel on Colmore Row, which continues to undergo major restoration.

Despite the recent £6m refurbishment at the Hyatt Regency, it has been several years since Birmingham offered a five-star hotel.

Latest supply is largely distributed across the three-star, four-star and budget segments, with around a third of the latter opening in the past five years. Accor, Hilton, IHG, Travelodge and Whitbread collectively account for over 50% of the current market and overall, major brand penetration will soon rise to over 80% of rooms in the city.

Alan Gordon, director, AM:PM

Development in the UK's second city Conferences and Crufts boost occupancy Birmingham, the central city in England, is a former industrial

powerhouse turned commercial hub. From saddles to services, manufacturing to marketing, the 'city of a thousand trades' benefits from a diverse history.

The recent past has witnessed the resurgence of the city centre, with developments including the Bull Ring, the mixed-use Mailbox, housing the four-star Malmaison, and the Library, all reaffirming Birmingham's out-of-the-box approach to architectural thinking.

Proposed development projects, such as the ambitious £450m transformation of Paradise Circus, are set to offer a rejuvenation of the public space

within the city with the linking of Chamberlain Square and Centenary Square.

The equally ambitious £400m Arena Central, the second world-class offering in the pipeline and a joint venture between Miller Developments and Bridgehouse Capital, is set to include a 210-bed Holiday Inn Express among the 2.3 million sq ft of mixed-use development.

The refurbishment of the Grand hotel continues with the hope of securing an operator for the 152-bed, Grade II-listed building, and demonstrates a confidence in hotel developers' expectations. This is combined with a number of proposed new hotels, including three- and four-star and budget providers. Our experience of the hotel market supports this, with the 110-bed Castle Bromwich Inn achieving in excess of asking price, good interest in the 62-bed Honiley Court, which sold from an asking price of £1.5m, and strong interest anticipated on our recent instruction in Evesham.

Added to this are the benefits of High Speed 2. The £22b first phase of the project is a potential game-changer, cutting the commute to London from one hour 21 minutes to just 49 minutes.

Tom Cunningham, associate director, Savills

Conferences and Crufts boost occupancy

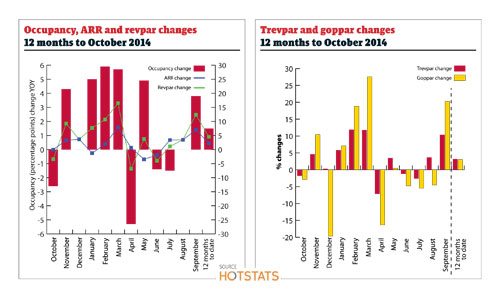

Birmingham has struggled to match the occupancy rate increases noted across the rest of the UK, with an improvement of just 1.5% from 68.1% in the year to September 2013 to 69.6% in the year to September 2014.

This is despite the city attracting a record 34 million visitors last year and being voted the best UK tourist destination for the second consecutive year

by readers of Group Leisure magazine.

The city continues to host significant events, notably the world's largest dog show, Crufts, which attracted 160,000 visitors in March 2014, a 7% rise on last year. Both occupancy rates and average room rate (ARR) were strong in this month.

September 2014 figures were undoubtedly boosted by the return of the Conservative autumn conference, with an estimated 14,000 delegates.

Occupancy rates of 78.7% and ARR of £81.74 in this month were the highest levels achieved in the last two years.

While occupancy rates and ARR have not grown at the same rate as other cities in the UK, the hotel industry in Birmingham has invested significantly in property developments, resulting in an additional 1,000 beds being made available in the past year, as well as a number of substantial new hotels currently under construction.

The majority of this investment is in luxury boutique hotels, which would be expected to increase ARR in the city. This, combined with the introduction of daily flights to New York, the return of the Ashes and the completion of the refurbishment of two train stations in 2015, suggest that the future of the industry in Birmingham is bright.

Gareth Jones, partner, Mazars UK