Come out fighting: Exclusive research into business leaders expectations for reopening

As operators get ready to square up to the most challenging period their companies may ever face, The Caterer and CGA surveyed business leaders to find out their predictions and plans for reopening

As hospitality businesses prepare to reopen, exclusive research of the leading operators in the country has found some optimism as bosses take on probably the most challenging time of their tenure.

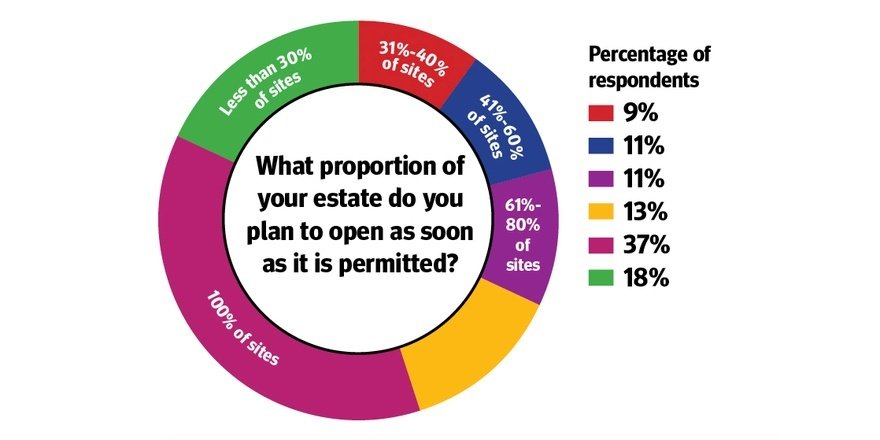

The Caterer's Business Leaders Recovery report, powered by CGA, which was undertaken in the days leading up to the confirmation that hospitality in England can reopen on 4 July, found that on average hospitality leaders will open 70% of their sites as soon as possible.

There is clearly enthusiasm for opening among the 164 business leaders quizzed, though this is tempered by more complex concerns around consumer trends, the legacy of the virus in terms of distancing and the unravelling of staff furlough.

CGA research and insight director Charlie Mitchell says that the results highlight some green shoots, despite the challenging climate to which hospitality will return: "Our hospitality leaders are demonstrating an eagerness to reopen the majority of their sites as quickly as is safe to do so, to capitalise on a pent-up demand from consumers from the hospitality experiences that have been missed over the lockdown period.

"However, the long-term impacts of the pandemic are predicted to have a lasting impact on the industry, extending into 2021. It will be establishments and operators that are able to successfully balance the fundamental, yet perhaps contrasting, needs of safety and experience that best navigate the recovery."

It will be establishments and operators that are able to successfully balance the fundamental, yet perhaps contrasting, needs of safety and experience that best navigate the recovery

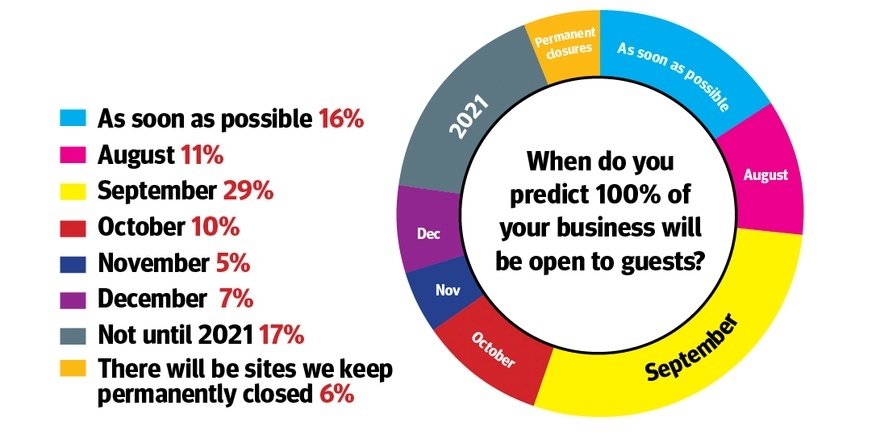

Encouragingly, the majority of the 164 business leaders quizzed say they plan to open all of their sites by September, although 17% won't be fully operational until 2021, with 6% stating some sites will permanently close.

Hotel industry consultant Melvin Gold says that though coronavirus has been the most extreme situation that anyone can remember, naturally operators are keen to get back up and running as soon as possible, and back into positive cashflow and profit. However, it is not as straightforward a decision as we would like, he says. "The survey clearly indicates the dichotomy of operators' optimism and enthusiasm, but also the challenges they have to consider."

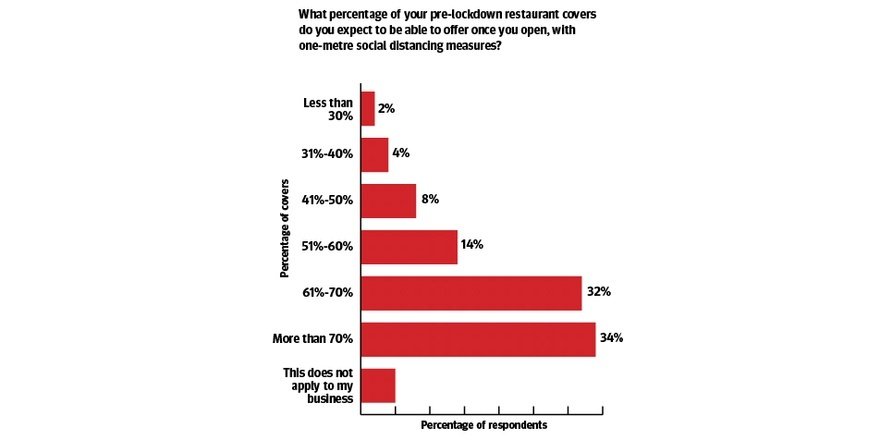

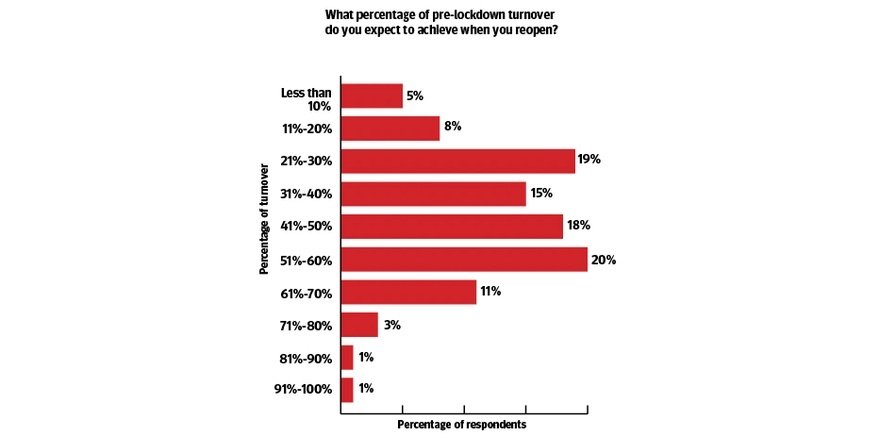

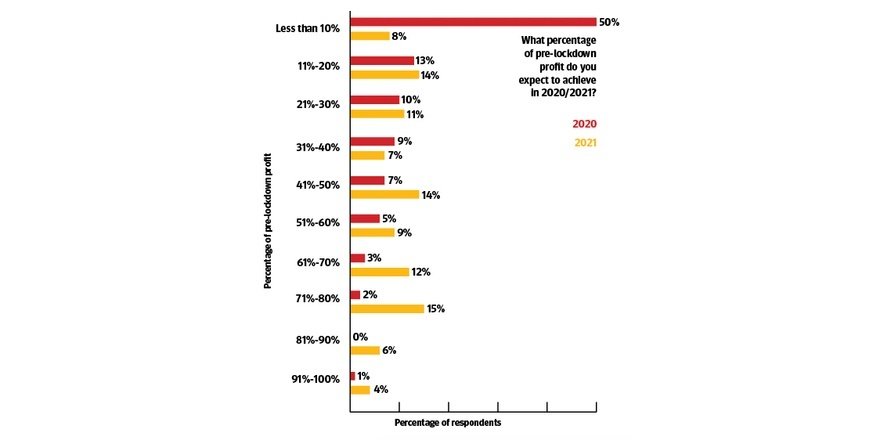

Businesses are being realistic in accepting that they cannot expect to open at their normal levels. The average percentage of pre-lockdown turnover leaders expect to achieve is 42%, with 50% of businesses predicting they will achieve less than 10% of their pre-lockdown profit in 2020, demonstrating the recovery process will not be easy and there will be some unfortunate losses along the way.

"They have to start somewhere and the resilience and creativity of the sector will come to the fore in reopening," Gold adds. "There is no doubt that operators are dependent on owners, investors, financiers and customers for support, and if any element of that fails, then the business will be at risk. But all parties are realistic about what has taken place and financial support will likely be forthcoming to businesses that demonstrate they will be viable."

The resilience and creativity of the sector will come to the fore in reopening

Staff down by one-third

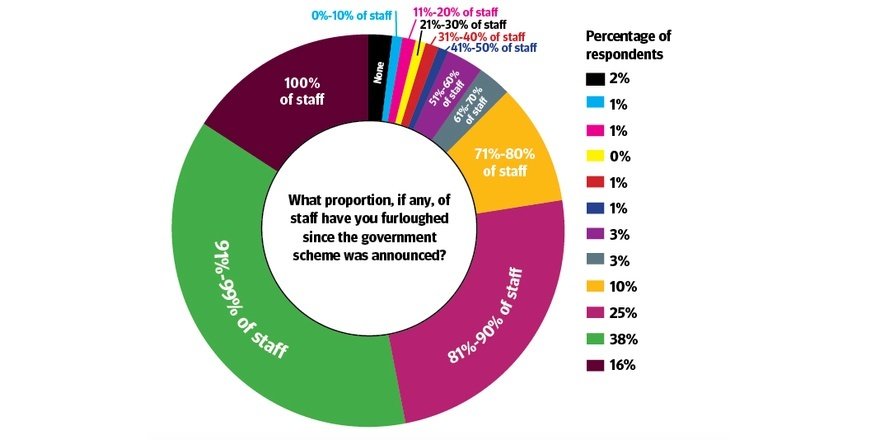

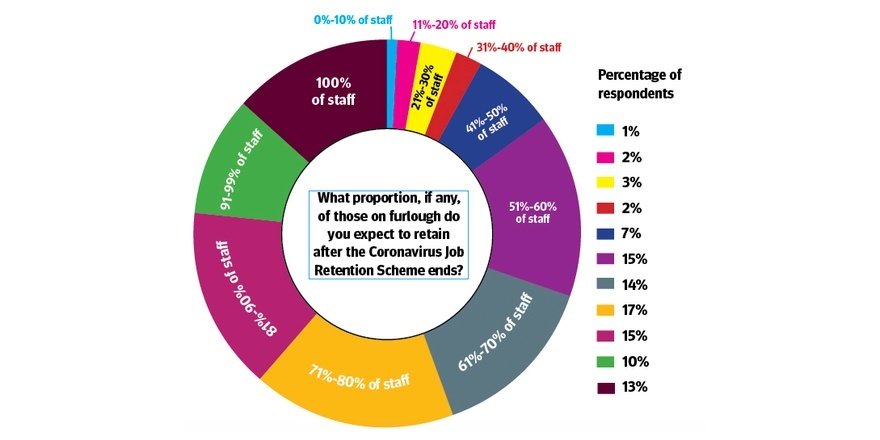

Some 79% of those polled said that they had furloughed at least 80% of their staff, demonstrating what a lifeline the coronavirus job retention scheme has been. However, on average leaders plan to retain 71% of their staff once the furlough scheme ends, indicating that almost a third of the workforce could be lost.

Mitchell says: "We know that operators are having to take difficult decisions on both the sites that they open and the staff that they retain, which may well result in a vastly different market to the one in which attracting staff was a key concern, less than six months ago. There will undoubtedly be significant job losses across the sector, amidst a backdrop of uncertainty around consumer confidence and demand."

His concerns are echoed by Gold, who says that with less than optimal trading ahead, losses in head count are inevitable. "Consumer attitudes are unknown, and most of hospitality's consumers are also employees in other businesses," he says. "The economic impact that is expected to follow the pandemic has been widely discussed and if its severity is as forecast then the impact on jobs will be especially evident, particularly in a sector that is in the eye of the storm as hospitality has been. I hate to take such a gloomy view, but it seems inevitable at this stage."

A question of confidence

The entire industry is hoping that there is pent-up demand among the public who have been denied a drink, meal and overnight stay, but there is some concern that the pandemic will have a dramatic effect on visitor numbers. Three-quarters of the business leaders were worried about consumer confidence in resuming visits to the hospitality sector, while debt levels came a close second in the list of concerns.

"I absolutely agree that consumer confidence is the key issue," Gold says, "If consumers return quickly, the worst effects of the pandemic and its economic impact can be minimised."

He adds that the situation will be complex and could combine to create "the most sour-tasting, age-related cocktail". Gold says: "The real outcome is complex, but I think it may also be generational to some extent. Older age groups have been hardest hit by the virus and may be the most difficult to entice. The value of the ‘grey pound' has been much discussed and is valued by many operators.

"Younger consumers may be bolder in terms of the potential impact of the virus, but may be more concerned about the economic consequences. A generation that has never known large-scale unemployment and a shortage of job opportunities may be forced to rein in their spending."

Loving local

When guests do return, it is expected that they will remain largely local, having had their parameters narrowed by months of lockdown. In line with this, business leaders are now more focused on tailoring their offer locally, with 44% considering this a key opportunity.

"Our research has confirmed that the majority of consumers who are currently working from home expect to work from home more in the future, which will have a significant impact on city centre and transport hub venues," Mitchell adds. "When you combine this with an increase desire to 'support local' we may well see a swing from city centre eating and drinking out, to more occasions taking place in suburban and rural areas. It will be vital for businesses to emphasise any local links, invest in the community and maintain their ethical and sustainability values to capture consumers with an increased scrutiny on where and what they eat and drink."

Local business will be more important than ever for hotels too, Gold says, even for those who have previously had a more international clientele. "This may well have an impact on revenue; consumers that travel further tend to be prepared to pay a higher price, in my experience," he adds.

"The last recession saw vouchers and discounts predominate and it is only relatively recently that we have seen that wane. Operators will be reluctant to see that trend return, especially with higher operating costs, but the fight for customers will be hard and all tools in the armoury will likely be needed."

Delivery is here to stay

With many operators having successfully established new revenue streams through delivery, the form is tipped for further success in the next 12 months, with 47% of leaders agreeing that third-party delivery services are well-positioned for success.

Some 32% of business leaders now predict delivery-only brands and dark kitchens will have a successful 12 months, an increase of 24% from February 2020, demonstrating that priorities and paths to success have clearly shifted in the light of Covid-19.

Mitchell at CGA says that delivery is part of a wider shift in outlook from the public and operators alike: "These fascinating shifts in opinion from hospitality leaders on trends, from pre-pandemic to now, highlight some of the broader trends that have been accelerated during this time, with a renewed focus on local chief among them.

"The changes in drinks trend predictions capture this perfectly, with a rise in craft beer, English wine, micro-distillery spirits and artisan coffee all linked to a more local, ethical and provenance-driven consumer."

Pre-booking now a prerequisite

When The Caterer surveyed business leaders in February, 23% were prioritising pre-booking and reservations as growth opportunities. This has now risen to 50% due to the impact of Covid-19.

"The environment will necessitate pre-booking as essential," Gold says. "Consumers will quickly understand that. It will make marketing and clinching that purchasing decision before the consumer has even left home even more vital.

"This is probably more important for restaurants and bars than for hotels, which have always been predominantly pre-booked. Venues dependent on the queue outside, or social media buzz creating a late purchase decision, now have a very different challenge. I am concerned that people may pre-book multiple places with a view to making a late decision, which would be a difficult operator challenge."

Hospitality Business Leaders Recovery Report

The full Hospitality Business Leaders Recovery Report is available to The Caterer Gold Club subscribers.

It features analysis of sentiment among leading figures in the industry taken in late June 2020, exploring the future for hospitality, the formats tipped for success, how operators are executing their reopening strategy and where they are prioritising their marketing.

Photos: Shutterstock

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In