Help yourself: How hoteliers can steal guests looking for bed, breakfast and evening meal

Hotels with a great food and beverage offer have a valuable weapon in their arsenal when it comes to tempting guests away from the likes of Airbnb. In the first in a series of Hotel F&B reports from The Caterer, powered by CGA, we explore how hoteliers can tap into an existing market. Rosalind Mullen reports

How important is food and beverage to the hotel industry? And why should hotels invest in it when there is such strong competition from specialist F&B outlets that are increasingly successful at meeting consumer demand for high quality, convenience and affordability?

The number of licensed hotels across Great Britain dropped by 4.1% in 2018, highlighting a contracting market, with challenges evident to the traditional hotel business. Disruptors have fundamentally changed the sector, including changing the way consumers use, book and even think about hotels.

###Airbnb shake-up

Airbnb in particular has proven to be a game changer, counting on 8.4 million guests annually, equating to 34% of all hotel users, indicating a huge crossover between traditional hotel visitors and Airbnb users. What’s more, the average Airbnb user is more likely to visit other types of hotels, over-indexing in particular for boutique city destinations, luxury venues and business hotels – suggesting that the platform is clearly cannibalising the traditional market, especially among traditionally higher spenders. Interestingly, users of Airbnb are less likely than average to use budget hotel chains, begging the question of whether the platform is taking the space previously occupied by these concepts.

CGA data has identified that a food and drink offer that resonates may be a weapon with which hotels can successfully fight back. Its research into the market highlights that the average Airbnb guest values food and drink when at hotels more than the average hotel guest and that the provision of such an offer will lead to higher levels of satisfaction, advocacy and, ultimately, visitation.

Airbnb users are more likely to use hotel bars, when available, than the average hotel visitor (55% using hotel bars most or every time vs 44% average), while 56% of Airbnb users state that the range of drinks is important in determining overall satisfaction of a hotel visit (vs 37% average).

What’s more, this is something fundamentally lacking within the Airbnb offering. The average guest at an Airbnb spends £100 throughout the course of their stay within the local economy, with a third of this on food. A further 10% is spent on groceries, amounting to £43, or 43% in total on food and drink – a not insignificant amount that is potentially up for grabs.

###How hotels can win

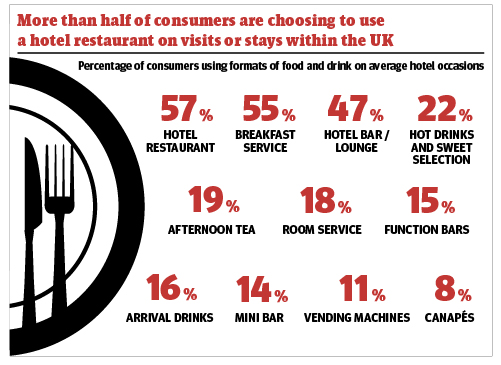

Given this demand and spend, provision of a fully licenced and high-quality food and beverage offer at hotels may increasingly tempt consumers to switch Airbnb for other hotel types and it is true that 60% of hotel guests typically eat or drink at their hotel when visiting.

The hotel bar is also a vital aspect of the food and drink offer within a hotel and is over-proportionally important in terms of visits. Although just under half of visitors (47%) typically go to hotel bars when visiting, this is weighted towards the most frequent consumers. Of guests who visit hotels monthly, 64% go to hotel bars most, or every time that they stay, compared to just 43% for one-off visitors. This importance is exaggerated further when looking at the spending footprint of those visiting hotel.

There is clearly a virtuous cycle, but provision of a great food and drinks offer that is seen to be high quality is a signpost of a great hotel and building this and communicating it effectively will result in a loyal, advocating customer base who will come back frequently and, crucially, spend.

##The Stardust Factor

Having a big name chef clearly gives a hotel restaurant more clout with customers. But finding the celebrity partner who can make such an outsourcing strategy pay is easier said than done.

Celebrity chefs such as Heston Blumenthal and Angela Hartnett don’t just draw restaurant bookings for five-star Grandes Dames such as Mandarin Oriental London and Lyme Wood in the New Forest. Indeed, for some guests it’s a strong reason why they choose those hotels. CGA found that 11% of British adults who use hotels said that “a named or celebrity chef” would be influential in their decision to eat or drink at a hotel restaurant, rising to 19% for 25- to 34-year-olds.

A dilemma faced by hotels balancing a tight budget is whether investment in a well-known chef will provide the necessary returns.

Robbie Bargh, founder of the Gorgeous Group says: “Outsourced F&B is a solution based on many factors, but the most important one will come down to location and how big does the opportunity look. Then there is the question of culture – finding an F&B partner with a track record of commercial and critical successes is one thing; finding one with the right culture is another.”

From a business angle, hoteliers need to assess whether potential partners are good managers and leaders, have a sound understanding of financial modelling and know how to market their business and make it locally relevant. Crucially, they need to understand the hotel audience – the drinks side, breakfast and events and meetings.

Bargh adds: “There has to be a similar ethos, vision and values. Hotels can’t just outsource – they need to find amazing partners that make sense to their brand and the guests’ experience ambition.”

Consultant Peter Backman comments: “The use of celebrity chefs is a perennial concern to hoteliers who struggle with making their restaurants pay – but in practice they only appear at high-end hotels (in London, Dubai and so on). Hotels have a problem selling space in the “Hilton restaurant” – it’s better to have “Tom Kerridge at the Corinthia”.

“Consumers (of all stripes) like celebrities to run the restaurants they visit – but are they going to pay [for that]? The average visitor to the average Hilton is much more likely to be happy to eat at the local ASK,” says Backman. “The majority of hotels are mid-spend, where guests want something relatively cheap, easy to access and where singles can eat alone easily. They aren’t fussed about celebrity chefs.”

Many hotels struggle with restaurants, but the nature of that struggle varies between type and location. Increasingly, those near urban locations are looking at ways to attract locals and maximise space. Fullers is opening an all-day-dining and co-working space at its Chamberlain hotel in London, joining the likes of the Hoxton and Village Hotels, which are using lobbies or creating workspaces to generate more fluid all-day dining. There is also a growth of hotels that strongly identify with the community through design, events and dining such as Hilton London Bankside.

This ties in with CGA’s findings, which show that 39% of hotel consumers say it is “extremely” or “very” important that the hotels that they visit “invest in the local community”, with 28% mentioning this as “not at all” or “only slightly” important. CGA comments that the fact consumers are looking to hotels to boost the local economy indicates they prefer in-house F&B provision.

Hotel industry consultant Melvin Gold sums it up: “There is no doubt that the use of a chef’s name can be an influencing factor in hotel restaurants. But where hoteliers create a modern restaurant with an interesting offer, and market it within their community and to hotel guests, it can be equally successful. Of course the use of a chef’s name is being paid for by the hotelier and ultimately by the customer. Use of similar funds in local marketing, profiling the hotel, chef and menu can have a similar impact if the restaurant is truly competitive and attractive.”

##Find out more

For the full Hotel F&B Report: The Future of Hotel Restaurants, click here.

Featured photo: Shutterstock